In 2024, The Hamilton Project produced and commissioned original research and policy proposals on some of our nation’s most pressing economic policy issues, from immigration to taxes to climate change. The visualizations below offer snapshots from THP’s work this year.

February: The US federal government faces pivotal climate tax choices in 2025.

The Hamilton Project began the year by looking ahead to 2025, when the expiration of many Tax Cuts and Jobs Act provisions could provide a crucial opportunity to improve the tax code. Because much of U.S. climate policy currently operates through the tax code, next year could also prove to be a pivotal year for climate policy.

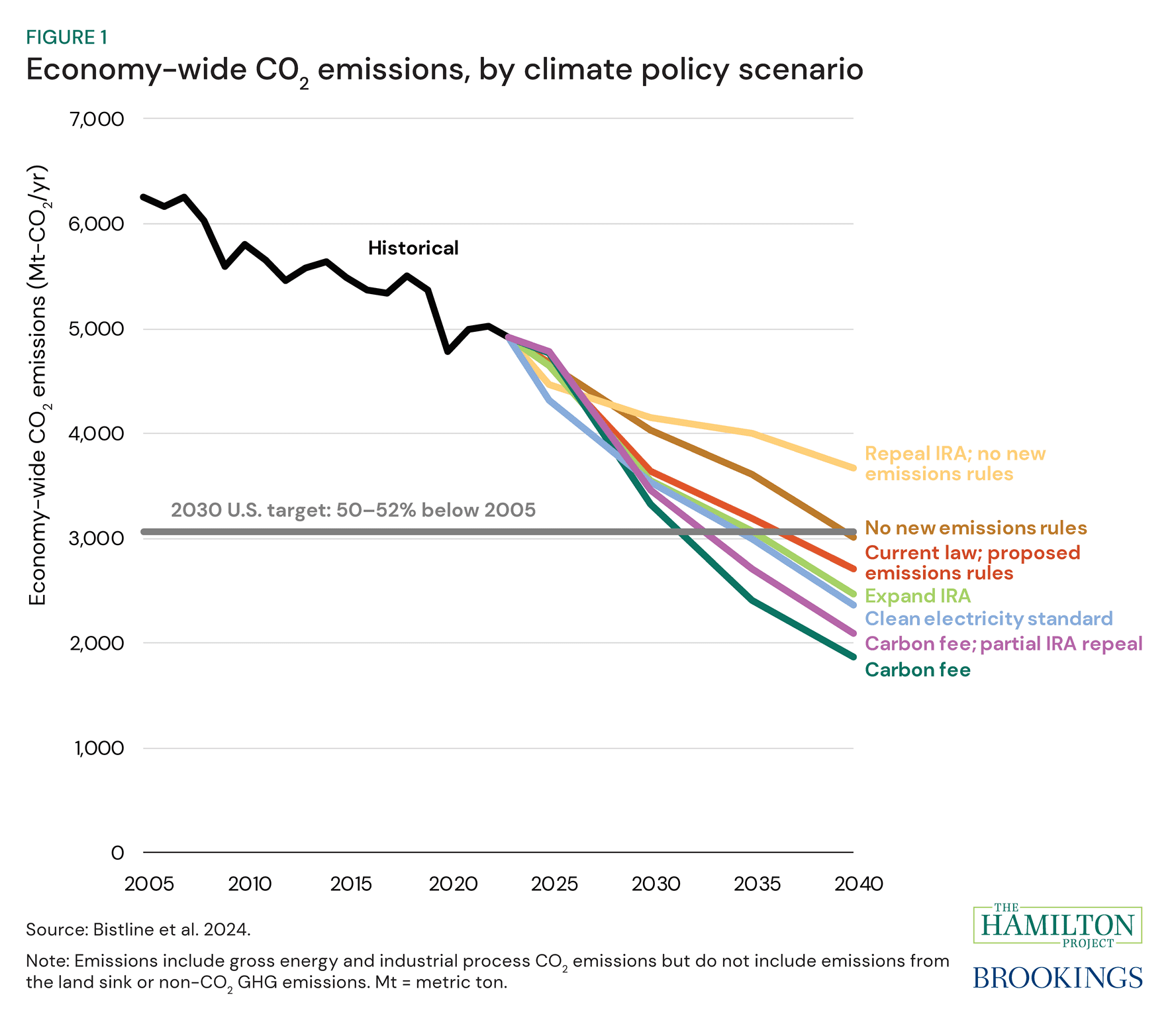

In a released NBER working paper and an accompanying THP analysis, John Bistline, Kimberly A. Clausing, Neil Mehrotra, James H. Stock, and Catherine Wolfram assess seven climate tax policy options that the U.S. federal government could consider in 2025. The authors evaluate the policies on three dimensions—emissions reductions, economic efficiency, and fiscal impact—and offer key findings across a range of policy scenarios. They find that emissions and net fiscal costs can be significantly reduced with the addition of a carbon fee, and that a carbon fee and clean electricity standard achieve 50–52 percent economy-wide emissions reduction between 2030 and 2035.

This analysis was released in conjunction with the event “Meeting climate goals through tax reform.” The Hamilton Project’s tax policy work also includes “Taking on tax,” a series of ongoing events starting in 2023 and continuing through 2025.

March: Immigration flows have been higher than projected—and have benefitted the labor market and the economy.

This analysis considers the macroeconomic implications of recent immigration flows, which updated numbers from the Congressional Budget Office suggest were much higher than previously projected. Authors Wendy Edelberg and Tara Watson estimate that the labor market in 2023 could accommodate employment growth of 160,000 to 230,000—compared to potential employment growth projections of 60,000 to 130,000—without putting pressure on inflation.

The surge in immigration helps to explain some of the surprising strength in consumer spending and overall economic growth since 2022, and, as the authors explain in an op-ed, underscores the role that immigration plays in powering the U.S. economy. This work was THP’s most-discussed publication of the year, with citations in The Wall Street Journal, Associated Press, The New York Times, and more.

April: The US safety net falls short for working-age adults who do not have dependent children and do not receive disability benefits.

In April 2024, The Hamilton Project hosted a webcast to discuss the gaps in the safety net for low-income working-age adults without dependents or government-determined disabilities. In conjunction with the event, The Hamilton Project released three papers; the first two explore the gaps in the safety net for this population, and the third compares the U.S. to other affluent countries that achieve greater poverty reduction for this group.

In their paper, Lauren Bauer, Bradley Hardy, and Olivia Howard address some of the misconceptions surrounding working-age adults who do not have dependent children and do not receive disability benefits. Indeed, while often called “ABAWDs” (able-bodied adults without dependents), many within this population are members of families and struggle with health issues that affect their ability to work. About 39 percent of low-income ABAWDs are parents. Nearly 32 percent of ABAWDs living under 200 percent of the federal poverty level report having a disability, and 24 percent report that a disability affects their ability to work.

May: Federal permitting reform is necessary but not sufficient to accelerate the building of clean energy infrastructure.

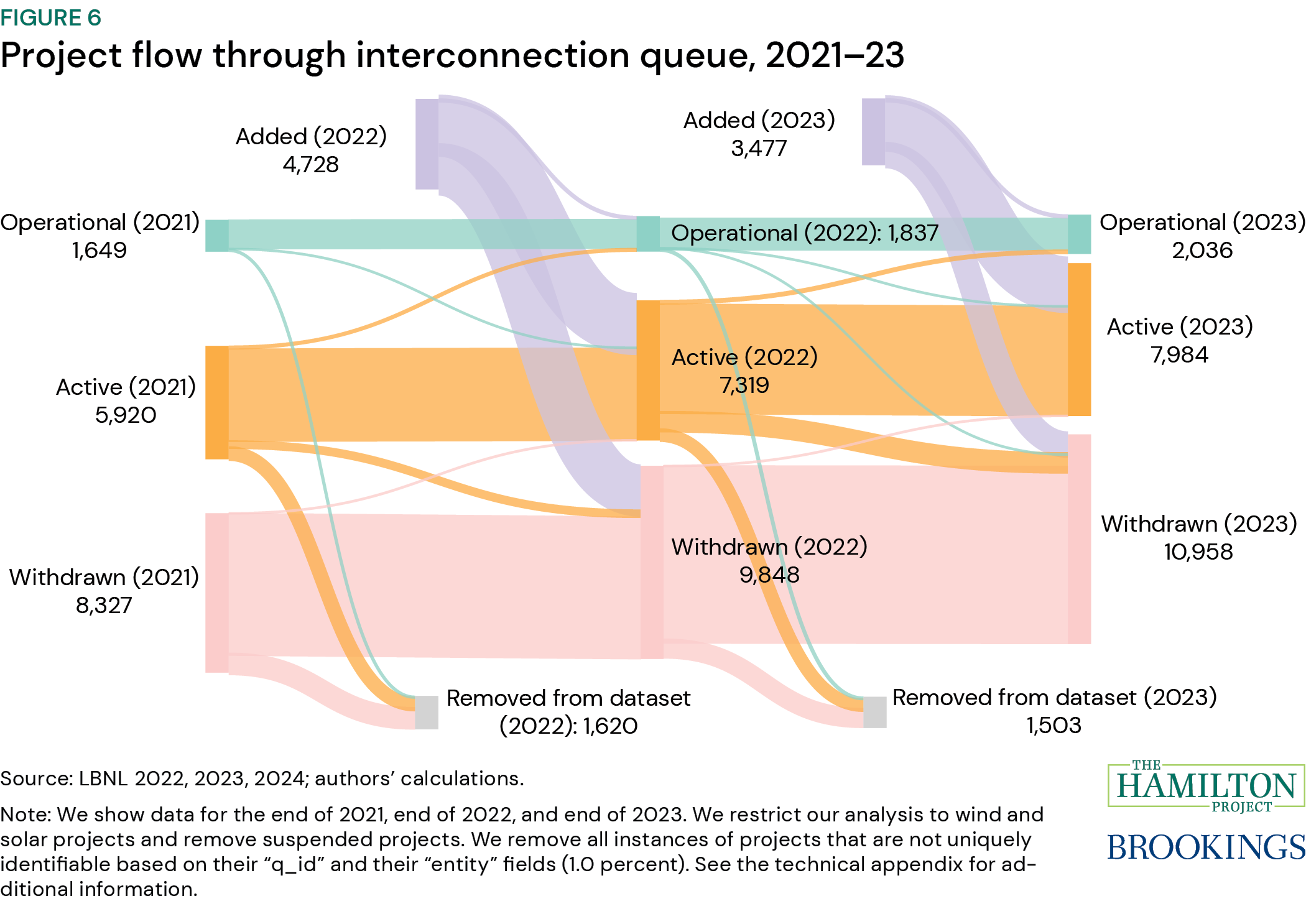

In this set of economic facts, The Hamilton Project examined the state of permitting reform and barriers to clean energy infrastructure projects. These facts show that permitting-related issues inhibiting project completion are typically at the state and local levels. Specifically, the authors identify community opposition and local ordinances and zoning requirements as some of the leading causes of wind and solar project cancellation. Finally, the slow grid interconnection process, and a surge in projects entering the queue, have left more capacity stuck in the queue than operating online.

This set of facts was released with a Hamilton Project and Stanford Doerr School of Sustainability event. The event also coincided with the release of two new policy proposals on grid governance and utility wildfire risk.

June: The education technology (EdTech) hype, which spiked during the COVID-19 pandemic, has faded.

The onset of the COVID-19 pandemic was followed by a substantial increase in investment in education technology (EdTech) to support remote learning. U.S. venture capital firms more than tripled their investment in EdTech in 2021, relative to 2020. However, this analysis by Sofoklis Goulas finds that venture capital investments collapsed after COVID-19 and argues that this may reflect, in part, challenges in delivering evidence of impact.

July: Prime-age women have powered, and continue to power, the labor force recovery.

In this July 2024 piece, The Hamilton Project found that prime-age women have contributed the most to the growth in aggregate labor force participation since 2019. Indeed, prime-age women exceeded their highest labor force participation rate ever this year. However, the authors also identify a plateau in participation among prime-age mothers with young children in recent months, signaling the need for greater investment in institutions that support working mothers.

For related work, see “Prime-age women are going above and beyond in the labor market recovery.”

August: Contrary to published estimates, employment for both US-born and foreign-born people increased in 2023.

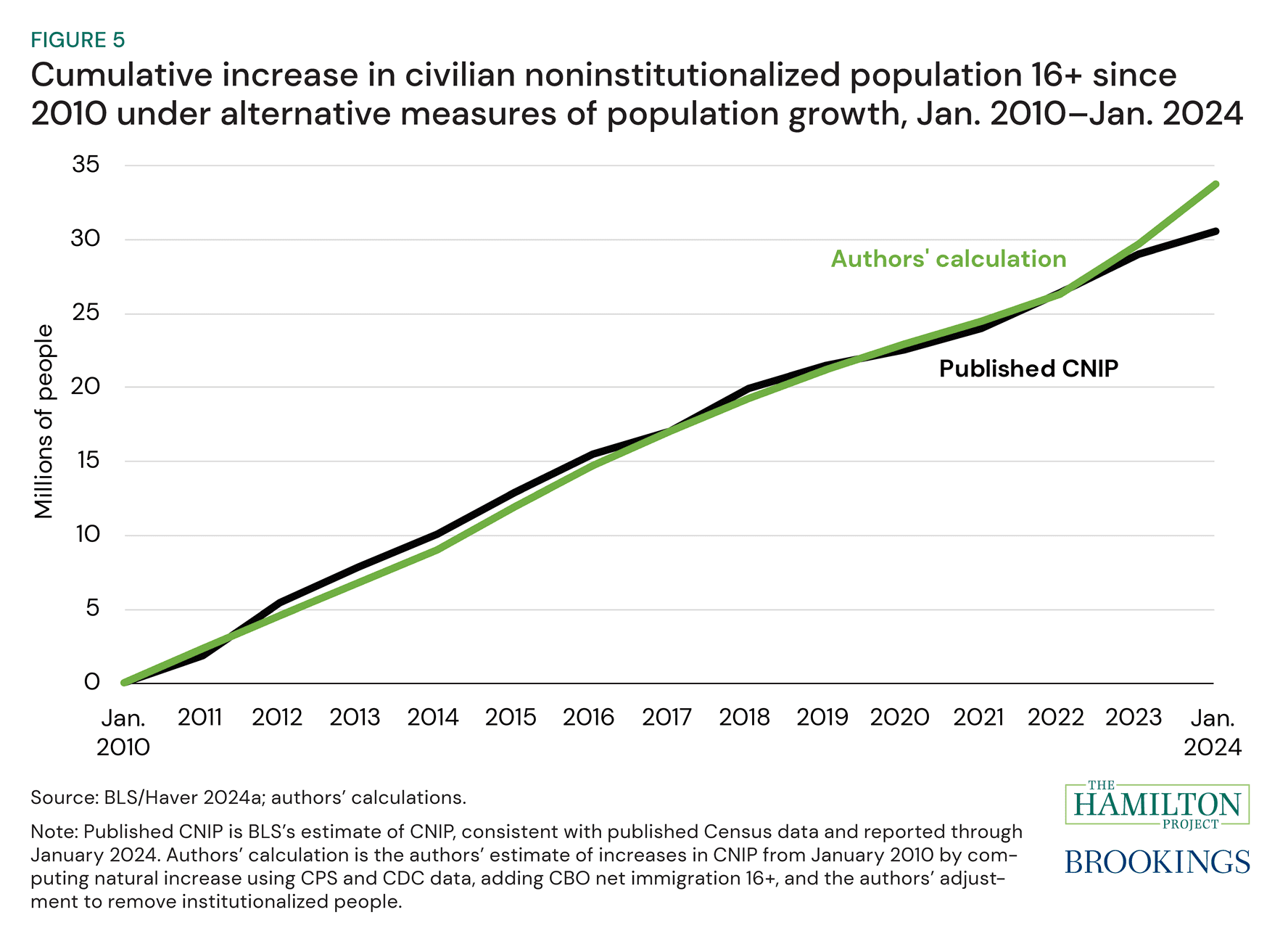

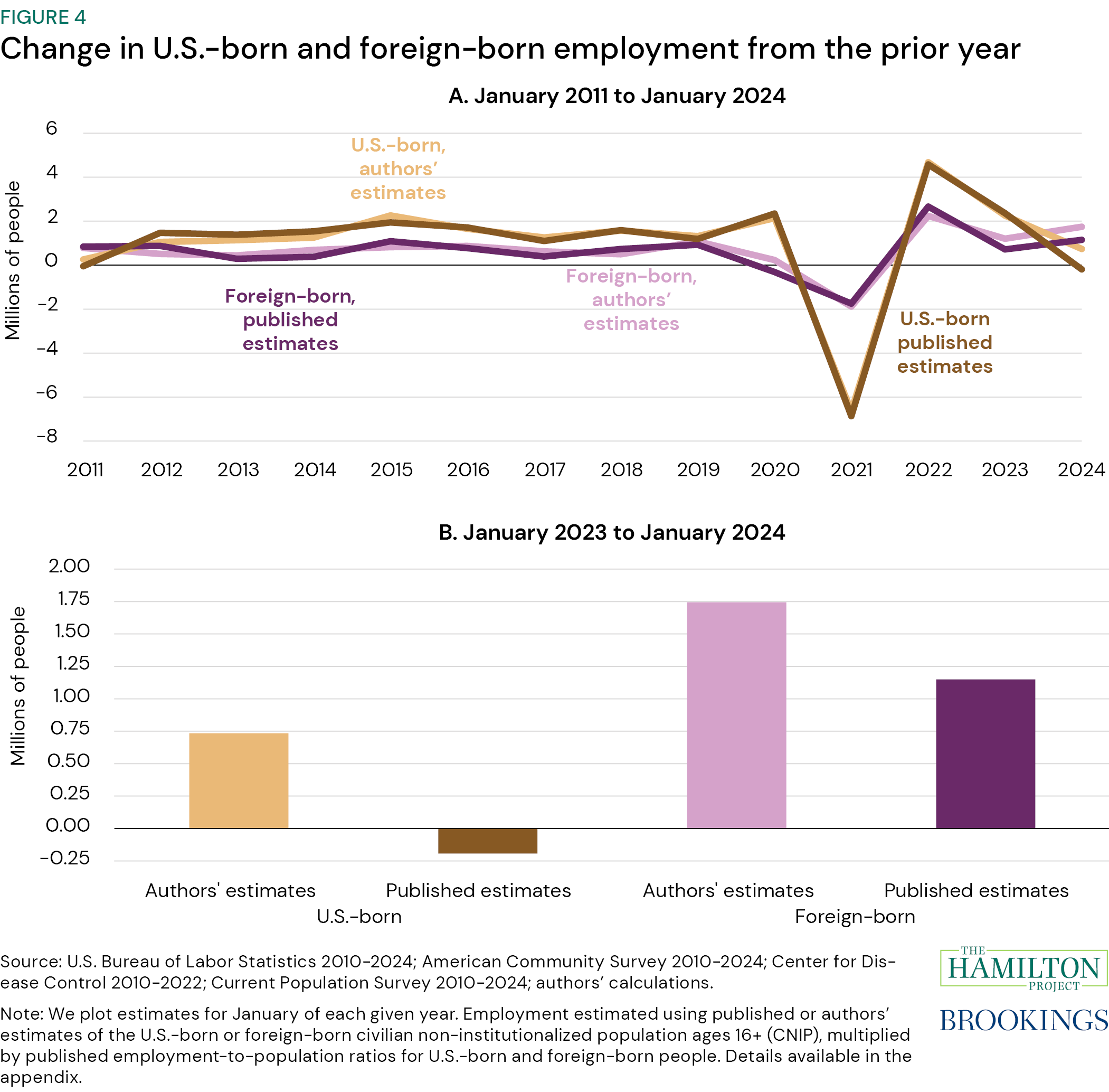

In August, Wendy Edelberg and Tara Watson returned to their previous work on the macroeconomic implications of higher-than-projected immigration flows. Their analysis finds that the published data underestimate recent population growth—and thus, employment growth among both foreign- and U.S.-born people. They estimate that U.S.-born employment increased by about 740,000 over the course of 2023; in contrast, the published data in the Current Population Survey show a decline of 190,000. Foreign-born employment increased by 1.7 million, larger than the 1.2 million in the published data.

Related Hamilton Project work on immigration includes “A more equitable distribution of the positive fiscal benefits of immigration” and “Which states need support in welcoming new immigrants?”

September: The tax treatment of partnerships has not attracted attention proportionate to their growing prevalence.

Partnerships are a large and growing slice of the economy, representing almost 30 percent of all business income in the United States and outnumbering C corporations. However, partnership tax rules have not been the subject of broad reform since their enactment in 1954, resulting in some critical weaknesses that generate wasteful planning, undermine equity, and reduce revenue. This September policy proposal offers principles and reforms to modernize partnership taxation, focusing on options most relevant to the 2025 tax policy debate.

This policy proposal was released in conjunction with an event, “Taking on tax: Modernizing partnership taxation,” co-hosted by The Hamilton Project and the Tax Law Center at NYU Law.

October: The United States is the only high-income country that does not guarantee workers paid time off.

In this October policy proposal, Betsey Stevenson proposes a modernization of the Fair Labor Standards Act (FLSA) that would give all workers the right to earn paid time off. A federal guarantee for earned paid time off could reduce administrative burdens for businesses, boost worker well-being and productivity, and better align U.S. workplace rules with those of other advanced economies, all of which mandate some form of paid leave for workers as part of a fair workplace.

November: Immigration policy under a second Trump administration will reduce 2025 GDP growth by $30 to $110 billion.

Few issues dominated the 2024 presidential contest like immigration. Published after the election, this analysis considers the macroeconomic implications of immigration policy in a second Trump administration. Wendy Edelberg, Cecilia Esterline, Stan Veuger, and Tara Watson estimate that immigration policy under the new Trump administration will reduce 2025 GDP growth by 0.1 to 0.4 percentage points, or $30 to $110 billion.

This piece is an update to “Immigration and the macroeconomy after 2024,” which was published prior to the election.

December: The labor market is still growing, but both workers and firms are behaving with caution.

In this December 2024 piece, The Hamilton Project used key indicators from the Job Openings and Labor Turnover Survey to investigate how firms are hiring and retaining workers. The authors find that while the labor market is still expanding, trends of a declining quit rate, and lower rates of job openings, separations, and hires, suggest that workers and firms are behaving with caution. The authors suggest that the labor market may be at a turning point.

To stay up to date with The Hamilton Project’s work in the upcoming year, sign up for our newsletter here.