To view the interactive, click here.

At the onset of the COVID-19 pandemic, existing unemployment insurance (UI) programs were unable to meet the extraordinary demand from workers abruptly displaced from their jobs. Programs authorized by Congress extended and expanded access to UI. Pandemic Unemployment Assistance (PUA) expanded access to UI benefits for up to 39 weeks for those not eligible for regular UI (like the self-employed). Pandemic Emergency Unemployment Compensation (PEUC) extended the number of weeks of benefits (by 13 weeks) that are available to regular UI recipients. Unemployment compensation programs support families who have lost employment, helping them to weather the economic crisis while promoting consumer spending more broadly.

In the US, the pandemic is surging and the labor market remains weak. But come December 26, without Congressional action, the pandemic-related UI programs will end. This is not the only benefit cliff that unemployed workers face. Compounding challenges for displaced workers are the potential end (or “triggering off”) of Extended Benefits (EB). EB, which automatically extends the number of weeks of UI benefits when certain economic conditions are met, has already triggered off in 20 states and is in danger of triggering off soon in many more.

States are less likely to take actions to keep EB in place because of cost: after December 31, the 100 percent federal funding of EB enacted in the CARES Act will expire, and the federal share will revert to 50 percent. Indeed, several states are set to sunset EB after December 31. Unless Congress and state governments act quickly, millions of unemployed people will be abruptly left with no income support and millions of others will face an imminent expiration of benefits.

Extending our prior work, we look at a snapshot of UI claims data released on December 3 by the Department of Labor to determine the different ways in which workers would lose unemployment compensation in the coming weeks. We find that absent Congressional and state government action the situation will be dire at the end of this year:

- approximately 9.5 million will lose unemployment compensation on December 26 due to PUA’s expiration;

- approximately 500,000 will lose unemployment compensation on December 26 due to PEUC’s expiration because they live in a state where EB has triggered off;

- approximately 870,000 will lose unemployment compensation once they exhaust regular UI benefits because they live in a state where EB has triggered off;

- approximately 680,000 will lose unemployment compensation once they exhaust EB; and

- approximately 2.2 million will be in danger of losing unemployment compensation once they exhaust regular benefits because they live in a state where EB is triggered on for now but is likely to trigger off within several weeks.

All told, at the end of December (based on a snapshot of claims data), approximately 10 million workers will lose unemployment compensation immediately on December 26 and about 3.8 million additional workers will be in danger of losing their benefits within weeks. Insofar as many of those unemployed people face such outcomes because EB has triggered off or is expected to trigger off soon, state governments can take action to prevent the loss of benefits by changing the economic measure that determines whether EB triggers off. In addition, extending PUA and PEUC would prevent millions from losing benefits and requires Congressional action.

The Insured Unemployment Rate and UI Eligibility

State governments have some latitude to extend EB.[1] UI participants may collect additional weeks of benefits through EB when the state’s 13-week insured unemployment rate (IUR; the share of people collecting UI benefits among the eligible population within a state) is above 5 percent and is at least 120 percent of the average in the prior two years. In addition to that mandatory trigger, states may adopt an optional trigger based on its IUR: EB can trigger on it those states where the IUR is above 6 percent without a lookback requirement. The second optional measure is based on the state-wide unemployment rate (the total unemployment rate or TUR); states that adopt this optional trigger allow EB to turn on when the TUR is above 6.5 percent and is at least 10 percent higher than either of the prior two years.

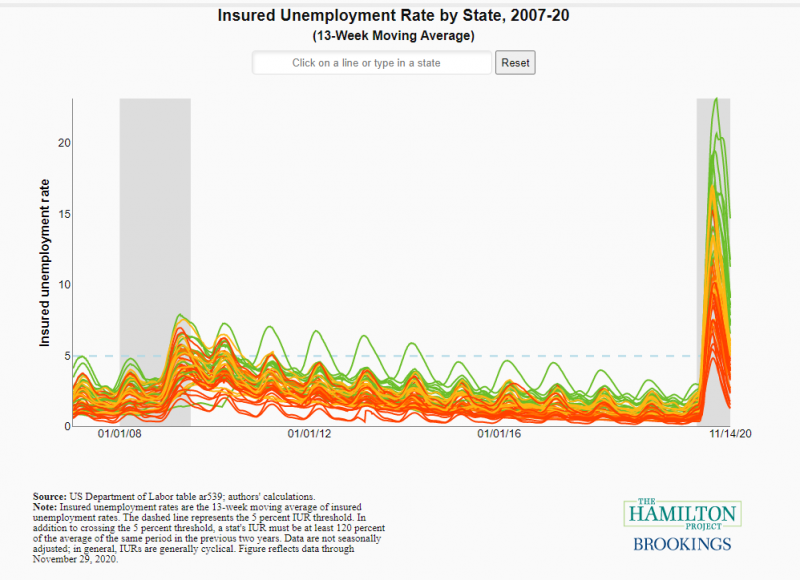

Figure 1 shows the 13-week average IURs for states (the mandatory EB trigger). To view the full interactive, click here. The dotted line is at the 5 percent line (the mandatory EB trigger threshold). The interactive shows whether states have EB triggered on, including for those states that adopted the TUR trigger, as of November 29. In every state except for South Dakota, EB was triggered on for some part of 2020. In 30 states, Washington DC, Puerto Rico, and the Virgin Islands, EB is still on.

Click on a line or enter a state name into the search bar to highlight 2007-2020 13-week IUR rates by state. The color of the line for each state reflects whether and how EB is triggered as of November 29 according to the Department of Labor:

- Red: EB is off in the state (20 states). For six of those states (Arkansas, Colorado, Florida, Kentucky, Maine, and Tennessee), EB is off because the state only uses the mandatory IUR trigger but would instead be on if the state also adopted the TUR trigger.

- Orange: EB is on by the TUR trigger and would be off by the IUR trigger (4 states). Under current plans, at least three of those states will trigger off on December 31 when 100 percent federal funding sunsets.

- Yellow: EB is on by the IUR trigger with an IUR between 5 and 6.5 percent (12 states).

- Green: EB is on by the IUR trigger with an IUR above 6.5 percent (14 states, Washington DC, Puerto Rico, and the Virgin Islands).

States that have particularly elevated IURs in 2020 (green) also generally have higher IURs from 2007 to 2019. States that have lower IURs in 2020 (red) also generally have lower IURs. This reflects not only differential industrial and demographic mixes between states that make IURs higher, but also state policy regimes that make it more difficult to receive UI and stay on UI. That is, state policy can depress IURs deliberately and mechanically.

Counterintuitively, poor economic conditions in a state eventually depress IURs, leading to a triggering off of EB in states. An IUR is the share of those who are receiving regular UI divided by the number of people who are covered by the UI system. As one would expect, if a beneficiary gets a job and so stops receiving regular UI, the IUR falls. More surprisingly, when beneficiaries stay unemployed but transfer out of regular UI and into the EB system (or onto a different emergency extension such as PEUC), they are also no longer counted in the IUR calculation. As a result, an increase in long-term unemployment – a clear indication of a weak labor market – can result in a reduction in the IUR and make it more likely that EB triggers off.

Consequences of UI Expirations

As of December 3, 2020, Department of Labor data show that 20.7 million people are currently participating in or have recently filed an initial claim for one of four unemployment compensation programs:

- 8.9 million are participating in PUA as of the week ending November 14 and 600,000 have filed initial claims for PUA in the last two weeks of November. PUA is a new and temporary program that provides unemployment assistance to workers not eligible for UI (or whose benefits from regular UI and other programs lapse before 39 weeks).

- 5.2 million people are on regular UI and about 700,000 filed initial UI claims the week ending November 28.

- 4.6 million people are on PEUC, a new and temporary program which extends the number of weeks that a person on UI can receive benefits; and

- 700,000 people are on EB, the UI extension program-in-law that allows for additional weeks of benefits when economic conditions in a state are met and when UI and PEUC are exhausted.

For consistency with the official data, this analysis relies on Department of Labor data as reported in the weekly claims for December 3, both initial and continuing claims.[2] Evidence suggests overreporting in those data, especially early in the pandemic. Due to delays in UI application processing, workers are often paid benefits retroactively, which can cause reporting issues; for example, if a worker only starts receiving benefits in their fifth week of unemployment, they are paid retroactively for the last four weeks and can show up in the Department of Labor’s data not as one person claiming five weeks of benefits, but as five separate claims. Such issues have been exacerbated by the logistical challenges stemming from standing up two new UI programs. Additionally, disinvestment in states’ UI computer systems have allowed cyberattacks to file fraudulent claims with state UI agencies. Those factors likely lead to overreporting in the number of unemployed people receiving UI benefits, particularly PUA. These reporting issues have lessened over time, as states worked through their backlog. While we employ the claims data as reported for this analysis, we concur with the GAO that the Department of Labor pursue reporting unique claims expeditiously.

The unemployment compensation program that an unemployed person is participating in (or applied for) and the state in which an unemployed person lives determines whether she will lose benefits immediately on December 26 and whether she will be able to transfer onto EB immediately, eventually, or not at all. We do not take into account possible inflows into these programs nor exhaustions or exits from the programs between when the data were reported on December 3 and the December 26 sunset date. Figure 2 walks through these determinations for the population on UI as of the UI claims notice released on December 3.

Based on this snapshot, approximately 10 million unemployed workers will lose benefits on December 26.

Based on this snapshot, approximately 10 million unemployed workers will lose benefits on December 26.

- PUA expiration: 9,477,058 (the total number of people the Department of Labor reports are receiving or have recently filed for PUA) workers will lose unemployment compensation immediately when PUA expires.

- PEUC expiration: 505,165 workers will lose unemployment compensation because of PEUC’s expiration and because they live in a state in which EB is triggered off.

There are 1.6 million unemployed workers who will lose unemployment compensation in the coming weeks because they will not be able to transfer onto EB or PUA when they exhaust their regular UI benefits or because they will exhaust their EB benefits.

- Exhaust UI and EB trigger off: 871,537 will lose unemployment compensation when they exhaust UI benefits because they live in a state in which EB is triggered off.

- Exhaust EB: 681,075 will lose unemployment compensation when they exhaust EB benefits. Some of those recipients would have been eligible for additional weeks of benefits through PUA.

Another 2.2 million unemployed workers are in danger of losing access to EB when they move off UI or are no longer eligible for PEUC come December 26.

- On UI or PEUC in a state with EB TUR trigger on: 683,256 are on UI or PEUC in a state where EB is triggered on only because the state has adopted the TUR trigger. Note that at least three of those states currently have plans to revert to the IUR trigger and thus trigger off EB after December 31.

- On UI or PEUC in a state with EB trigger on and IUR between 5 percent and 6.5 percent: 1,548,315 are on UI or PEUC in a state where EB is triggered on but the state has an IUR between 5 percent and 6.5 percent, close to the 5 percent threshold.

Finally, another 6.9 million unemployed workers are not imminently in danger of losing access to unemployment compensation because they live in a state in which the insured unemployment rate is currently above 6.5 percent. Among that group, 3.3 million will switch immediately to EB from PEUC on December 26 and 3.6 million will likely switch to EB if they exhaust UI before finding employment.[3]

Conclusion

This winter, there are too many different ways for the unemployed to lose unemployment compensation. We predicted in August that EB triggers would lapse prematurely, dampening the stabilizing aspects of UI and denying additional weeks of benefits to those who have struggled to gain a toe-hold in a labor market still shaped by the pandemic. That prediction has started to come to pass. The confluence of expiring pandemic-related programs with EB triggers turning off well before the economy has recovered means that approximately 13.8 million unemployed workers, including the long-term unemployed, will lose sustaining unemployment compensation on December 26 or are in danger of losing compensation in the following weeks.

Eliminating UI benefits for millions of unemployed workers will likely cut deep into household consumption, which makes up roughly 70 percent of U.S. GDP. Since August, UI benefits have typically been about 50 percent of a recipient’s previous wage, providing significant support but still requiring a substantial cut in household spending. Moreover, the drop in consumer spending from the lapse in benefits threatens to derail the fragile economic recovery.

Eliminating unemployment compensation while the labor market is weak creates enormous economic pain for households and for the tenuous economic recovery. Moreover, because the labor market pain has not been borne equally across demographic groups, the lapsing of benefits would also not be equally felt. Employment among low-wage service workers has taken a disproportionately large hit in this crisis, and those jobs are disproportionately held by women and people of color. With those demographic group suffering greater unemployment, those groups will face greater pain from the lapse in benefits in coming weeks.

There are other downstream consequences to EB triggering off that further weaken the safety net and make it more difficult for low-wage workers during economic downturns. When EB is triggered on in a state, states may apply to the US Department of Agriculture for a waiver for Supplemental Nutrition Assistance Program (SNAP) work requirements, which bind on able-bodied adults without dependents. During the Great Recession the UI-system-related work requirement waivers provided the highest degree of waiver coverage during the sluggish recovery. Because EB triggered on so quickly in 2020 and has started to trigger off, many states will not have SNAP work requirement waiver eligibility based on EB when the nationwide work requirement suspension ends.

As described above, state governments have some latitude to extend EB as they have a choice among triggers that determine when EB turns off but are more likely to do so with substantial federal support. Four states are currently turned on by TUR that would be turned off if they had not adopted the optional trigger; six states (Arkansas, Colorado, Florida, Kentucky, Maine, and Tennessee) would have EB triggered on now if they had adopted the TUR trigger. But at least three of the states currently turned on by TUR will trigger off on December 31 because of state laws that tie the optional trigger to 100 percent federal funding. Although opting out of a trigger that would keep EB in place lowers state government UI costs, which may be a high priority for states right now given budget crises, it leaves millions of unemployed workers in a dire financial situation now and affects some SNAP participants later.

As federal policymakers consider additional fiscal support in response to the COVID pandemic, it is imperative that a robust unemployment compensation extension is a core component of any legislative package. The economy is still in a “big hole,” the economic recovery is weakening, and there are clear signs that the labor market has sustained structural damage. Allowing unemployment compensation to lapse – through the expiration of PUA, PEUC, and the 100% federal match of EB – threatens vulnerable workers and the fragile economic recovery.

Acknowledgments: The authors thank Elizabeth Pancotti, Kriston McIntosh, and Kristen Broady for fruitful conversations and helpful feedback as well as Jay Shambaugh and Jana Parsons for their work on earlier publications in this line of research. Becca Portman developed the data interactive, Lexi Contreras provided graphic design, and Jennifer Umanzor contributed research assistance.

[1] For additional details on EB triggers, please see Bauer, Edelberg, and Parsons (2020) and Chodorow-Reich and Coglianese (2019).

[2]We take as the snapshot both initial and continuing claims as reported in the December 3, 2020 notice. PUA initial claims reported here were filed during the week ending November 28 and the week ending November 21; PUA continued claims are for the week ending November 14. For the numbers reported here, UI initial claims were filed during the week ending November 28 and insured unemployment for the week ending November 21. PEUC claims and EB claims were filed during the week ending November 14.

[3] The analysis reported here looks only at the snapshot of claims reported on December 3. In their analysis, Elizabeth Pancotti and Andrew Stettner model out ongoing flows into and out of unemployment compensation programs to project the number of program participants on December 26 and find that more than 16 million workers will lose access to unemployment compensation by the end of 2020, through a combination of eligibility exhaustion and the benefit cliff. They also project out IURs and TURs to model where EB triggers will be on December 26 and December 31. While our estimates on the number of participants affected are converging as we get closer to these dates and claims data move toward their model, much of the daylight between our estimates reflect differences in approach.