Even if policymakers raise the debt ceiling in time to prevent its constraining payments, the economic effects are unambiguously negative. Watchers of scheduled U.S. federal payments and projected tax revenues worry that if the debt ceiling is not raised, Treasury could run short of resources to pay its obligations as early as June 1, the so-called “X-date.”

We find that the relatively large premium being charged now on Treasury securities maturing in June suggests that financial markets are concerned that principal payments will indeed be delayed and more so than in prior debt limit standoffs. The increase in interest rates represents a cost to taxpayers and a lack of confidence among investors. Moreover, the negative effects could be persistent even after the debt ceiling is eventually increased. At the very least, investors would likely anticipate short-term interruptions in federal payments each time the debt limit nears, a significant escalation from their current expectations for negotiations to run right up to the last minute.

The increase in interest rates represents a cost to taxpayers and a lack of confidence among investors. Moreover, the negative effects could be persistent even after the debt ceiling is eventually increased.

Up until now, the U.S. government has enjoyed a borrowing rate that is estimated to be lower by roughly ¼ percentage point, meaning interest savings of more than $750 billion over the next decade. If a portion of this advantage were lost by allowing the debt limit to bind, the cost to the taxpayer could be significant. Already, financial markets are concerned.

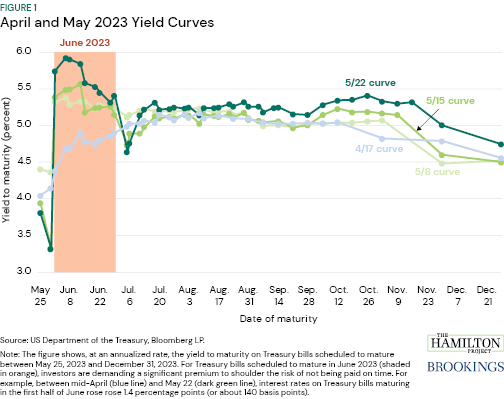

For Treasury bills that are scheduled to mature in June, investors are demanding a significant premium of 1.4 percentage points, or about 140 basis points, to shoulder the risk of not being paid on time (figure 1). For example, between mid-April (blue line) and May 22 (dark green line), interest rates on Treasury bills maturing on June 1 rose from 4.4 percent to 5.7 percent. To give a sense of how consequential an increase of this magnitude is, consider the hypothetical that all interest rates for all maturities rose by this much and the premium was persistent: interest costs to finance the federal debt would increase by $4.10 trillion.

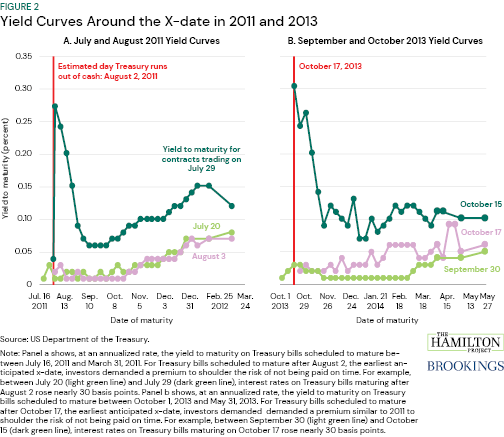

The premium being charged is significantly larger and rose significantly earlier than during the last-minute debt ceiling negotiations in 2011 and 2013. As shown in figure 2, in 2011, interest rates on Treasury bills maturing right after the earliest anticipated X-date, August 2, started to rise only in late July. Between July 20 (light green line) and July 29 (dark green line), interest rates on these bills rose nearly 30 basis points. It fell immediately after the debt ceiling was raised in early August (purple line).

In 2013, there was a similar increase in the interest rates on Treasury bills scheduled to mature near the anticipated X-date, October 17. As shown in figure 3, like in 2011, there was a 30 basis point increase in yields on these bills between late September (light green line) and mid-October (dark green line). As discussed in a Hutchins Center Explains post, when Congress waited until the last minute to raise the debt ceiling in 2013, rates rose on Treasury securities scheduled to mature near the projected date the debt limit was expected to bind—by between 21 basis points and 46 basis points, according to an estimate from Federal Reserve economists—and liquidity in the Treasury securities market contracted. Yields across all maturities also increased a bit—by between 4 basis points and 8 basis points—reflecting investors’ fears of broader financial contagion.

Should the debt ceiling bind, the negative economic effects would quickly mount and risk triggering a deep recession. As Edelberg and Louise Sheiner discussed in a recent piece:

There is enormous uncertainty regarding the damage the U.S. economy would incur, as it depends on how long the situation lasts, how it is managed, and the extent to which investors alter their views about the safety of Treasury securities. Would the stock market tumble precipitously the first day that a non-interest payment is delayed? Would the Treasury securities market, the world’s most important, function smoothly? Would there be a run on money market funds that hold short-term Treasury securities? What actions would the Federal Reserve take to stabilize financial markets and the economy more broadly?