A policy proposal by Jason Brown and Gopi Shah Goda assesses how Medicare Savings Programs (MSPs) provide access to and financial support for high-quality and comprehensive health care for low-means senior citizens. The proposal recommends policies to improve how the program can reach more eligible seniors and provide more continuous support.

The challenge

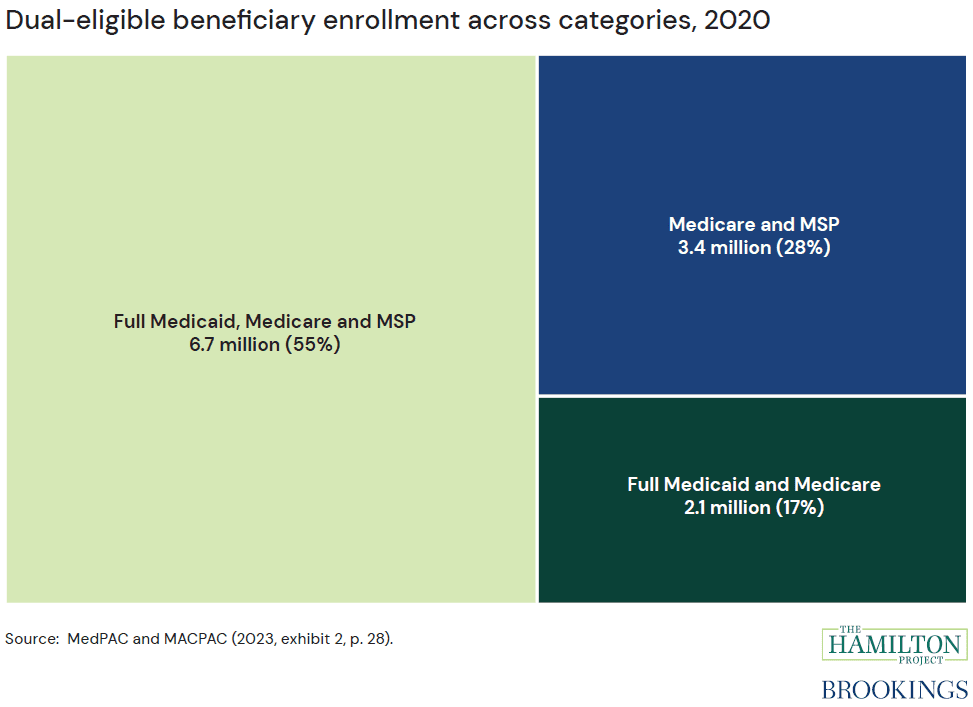

The Medicare and Medicaid programs provide health insurance to the elderly, disabled, and people with limited income. Today, more than 12 million people receive support from both programs, including dual-enrolled beneficiaries who receive full Medicaid and Medicare benefits, those who receive support to cover Medicare premiums and cost sharing through MSPs, and those who receive full Medicaid and Medicare benefits and are enrolled in an MSP (see figure 1). MSPs consist of four separate programs that vary in their eligibility criteria and coverage. These programs are run by state Medicaid agencies with federally-established minimum eligibility criteria pertaining to income and assets, which states may relax or waive altogether.

While these programs serve to reduce the burden of high health care costs for low-income Medicare beneficiaries, certain factors hamper the programs’ effectiveness. Millions of seniors who qualify for these programs are not enrolled, forgoing considerable support for which they are qualified. Sharp eligibility thresholds create discontinuous drops in financial support for premiums and cost sharing. With the disproportionately high spending on dual enrollees, policymakers have an interest in ensuring that the programs target those with the greatest need.

The proposal

The authors describe issues that low-income Medicare beneficiaries face in accessing and coordinating care, and they present a framework for potential reforms. In their Hamilton Project policy proposal, Brown and Goda make the following recommendations to improve how MSPs assist low-means senior citizens:

1. Increase enrollment among eligible populations. Effectively reaching low-income populations requires a set of program changes that together could reduce frictions that prevent take-up and support continuous eligibility. These changes include:

- Automatically enrolling eligible beneficiaries;

- Streamlining eligibility determination for MSPs at the time of Medicare enrollment, including by using lifetime earnings; and,

- Eliminating annual recertification for those aged 65 and above.

2. Replace the current schedule of premium and cost-sharing support with a sliding scale that eliminates sharp changes in benefit eligibility as income changes. Sharp changes in benefit eligibility at income thresholds can result in an inequitable allocation of benefits between individuals just below and above the threshold. This can be ameliorated by smoothing the benefit structure such that each additional dollar in lifetime income reduces benefits proportionally. The authors do not specify the full parameters of a new benefit schedule.

The proposal does not address what the “right” size of the Medicare Savings Programs should be. The proposal’s goal is to lay out the broad structure of a more rationally designed program and to explain the trade-offs involved in different parameter choices. To help illustrate the trade-offs, the authors present options under various budget scenarios based on the current program’s parameters.