The COVID-19 pandemic caused significant shifts in real estate markets, such as increased urban-to-suburban migration, residential rent and housing affordability issues, and reduced value of urban office and retail real estate due to the mass adoption of remote work. Additionally, the climate change crisis is leading to upcoming building regulations to reduce greenhouse gas (GHG) emissions. Converting brown buildings to uses that are in greater demand, such as apartments, is generally more responsible for the climate than razing such buildings and subsequently rebuilding from scratch.

Three conditions must be met for a conversion to take place: (i) The building has to be physically suitable; (ii) the zoning and building codes have to permit such a conversion; and (iii) the financial return of the conversion has to compensate the developer for the risk they are taking.

In their Hamilton Project policy proposal, Arpit Gupta (New York University Stern School of Business), Candy Martinez (Columbia Business School), and Stijn Van Nieuwerburgh (Columbia Business School) discuss all three necessary conditions and suggest pathways for making more office properties viable candidates for conversion into apartment buildings.

The challenge

Gupta, Martinez, and Van Nieuwerburgh argue that while there is an undersupply of residential properties, there is an oversupply of office space. The demand for commercial office space is expected to remain weak due to the mass adoption of remote work, leading to record high vacancy rates and decreased office rent growth, and sparking concerns that some office buildings have become stranded assets. At the same time, the real estate sector is a major target for emissions-reduction policies.

This proposal presents conversion as a swifter, less expensive, and less environmentally damaging adaptive reuse of existing buildings compared with demolishing them and constructing new ones. The rehabilitation of existing buildings produces 50 percent to 75 percent fewer carbon emissions than demolition and new construction.

A key hurdle in successfully implementing office conversions is the physical suitability of the office for conversion to apartments. Gupta, Martinez, and Van Nieuwerburgh identify buildings that are plausible candidates for office conversion based on their physical characteristics. Buildings with substantial remaining office tenancy are unlikely to be viable candidates for conversion. The takeaway from the analysis is that a nationwide conversion strategy is viable because of the considerable number of plausible conversion candidates across the country.

Gupta, Martinez, and Van Nieuwerburgh identify the location of 2,431 conversion candidates. At 875 square feet per apartment unit, and after incorporating a 30 percent loss factor, these conversions could create 158,654 additional housing units. Scaling up incomplete data results in 367,750 apartment units. For comparison, about 260,000 apartment units were created in the U.S. in a typical year between 2001 and 2022. The final conversion candidate sample accounts for 773,050 tons of predicted carbon dioxide (CO2) emissions. Scaling up incomplete data results in 1,775,042 tons of predicted carbon emissions.

Gupta, Martinez, and Van Nieuwerburgh propose a model to demonstrate the financial viability of transforming traditional brown office buildings into ecofriendly apartments. The authors consider the triple headwinds of rising interest rates, the emergence and persistence of remote work, and GHG emission taxes which lower office values. They find there is substantial value for investors in making these conversions.

The proposal

This proposal highlights existing channels for policymakers at the federal and local government levels to financially subsidize conversions. Gupta, Martinez, and Van Nieuwerburgh argue that the Inflation Reduction Act (IRA) could be a promising route. Under this proposal, market-rate conversion projects that turn brown offices into green apartments should qualify for $12 billion in grants to reduce or avoid GHG emissions from the Greenhouse Gas Reduction Fund (GGRF). If such conversions also contain an affordable component, they should qualify for another $8 billion in grants earmarked to enable low-income and disadvantaged communities to utilize zero-emission technologies and $7 billion in grants for climate-related activities in low-income and disadvantaged communities from the GGRF.

The proposal also identifies other federal government resources. The $9-billion Low-Income Housing Tax Credit (LIHTC) program provides funds for the construction of new affordable housing properties and the rehabbing of existing properties in low-income areas. The Federal Home Loan Bank, Fannie Mae, and Freddie Mac, which all run large affordable housing finance programs, have recently taken a renewed interest in climate change. There is an opportunity for the creation of a new office conversion finance program, with special modalities for ecofriendly conversions.

Regarding local government resources, Gupta, Martinez, and Van Nieuwerburgh claim that a decline in property values and property tax revenues from urban offices and retail will be followed by increased property tax revenues from office conversions. The authors argue that from the local government’s perspective, an office conversion is an investment in future tax revenue.

This proposal shows that imposing a requirement on the conversion that 20 percent of apartment units be affordable renders the net present value negative, so the developer will not pursue the opportunity. To increase the net present value of affordable development, local governments can provide a property tax abatement during the affordability period.

Gupta, Martinez, and Van Nieuwerburgh ask how the calculus changes if they use IRA funding to pay for the green upgrades in the conversion. This IRA subsidy increases the net present value from -$8.6 million to -$0.3 million in a hypothetical conversion. Only a small property tax abatement of 1.5 percent is needed to lift the net present value to zero. These calculations suggest that policymakers will have to choose between conversions that create market-rate units and conversions that include affordable units where additional subsidies are provided. The authors argue that another commonly implemented housing policy involves lowering the cost of debt for affordable housing projects.

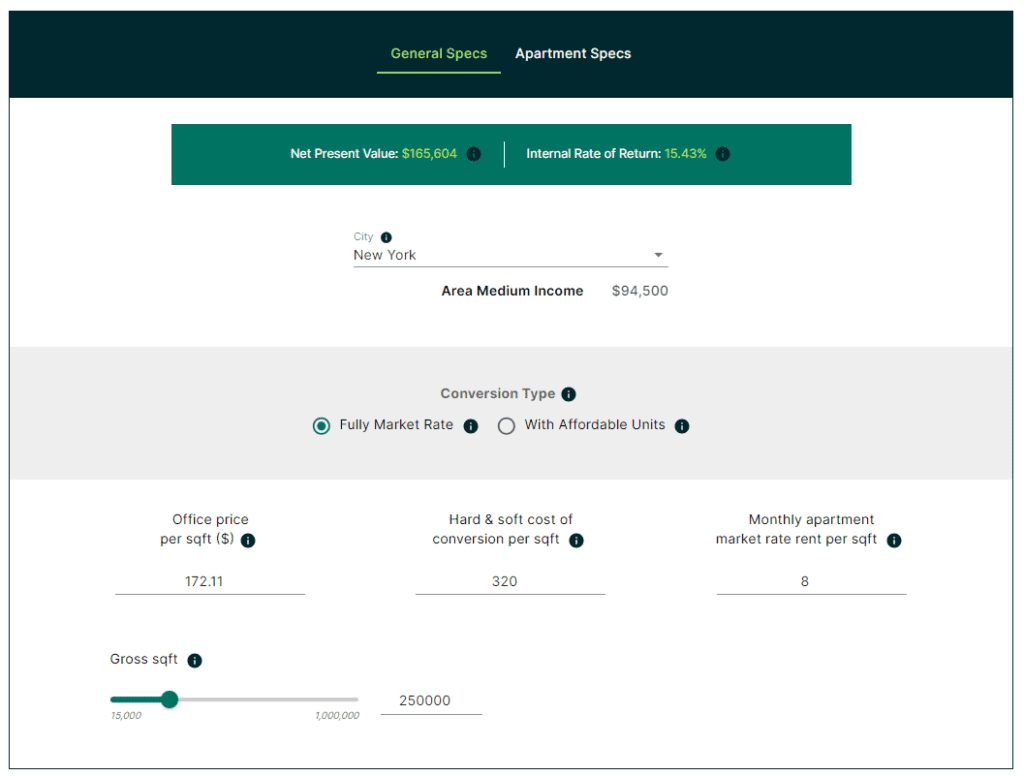

The authors provide a financial calculator to identify conversions eligible for subsidies and to assess the size of the subsidy. The basic idea is that conversion projects can apply for IRA funds for the smaller amount of the green capital expenditure component of the conversion and the subsidy that brings the project’s net present value to zero.

Gupta, Martinez, and Van Nieuwerburgh encourage policymakers to broaden eligibility of IRA funding to for-profit developers, potentially in a joint venture with nonprofits. After incorporating federal subsidies, local governments could plug in assumptions about the market conditions for the property in question, select a desired level of affordable housing, and then compute the necessary subsidies required for a project to pencil out. After identifying potential conversions that meet the above criteria, the authors propose that the federal government subsidizes only the conversions that are not otherwise profitable.

The authors also propose changing local regulations and other nonfinancial policies to spur conversions, such as zoning rule and housing code changes. The authors argue that rezoning should be enabled as of right, meaning that owners should be able to convert buildings without being required to file for discretionary permits. The authors suggest going even further to provide additional density bonuses for conversion targets to accommodate additional residential units, especially when the building height is below neighboring properties.

Under this proposal, local municipalities may also need to revisit certain building code features, such as the requirements that each bedroom have a window. The principles of office-to-apartment conversions apply equally to urban and suburban locations. The main consideration that sets urban areas apart is the presence of significant amenities, access to public transit, and agglomeration benefits from thick labor markets.

Conclusion

The urban exodus, housing affordability issues, the di- minished value of urban offices due to the widespread adoption of remote work, and higher interest rates add up to a challenging environment for real estate. This policy proposal shows how to incentivize the conversion of underused Class A−/B/C office buildings into green apartments. Gupta, Martinez, and Van Nieuwerburgh present a pro forma model to demonstrate that such transformations are environmentally responsible and financially viable under current market conditions as long as buildings are able to transact at fair values. The authors identify many conversion targets in cities across the country. The proposal identifies federal subsidy funds from the IRA to help finance these green projects. The execution of this proposal will require concerted efforts from multiple stakeholders, involving modifications to local zoning regulations, building code adjustments, and local budgetary allocations. While challenges abound, the potential to reshape urban landscapes is immense.