A Hamilton Project analysis of the business sector over the COVID-19 period finds that, despite initial fears of widespread failure, existing businesses and new entrepreneurship have defied earlier expectations, ending 2021 with nearly 450,000 more establishments in operation than prior to the pandemic. Underneath these aggregate results, patterns across industries reveal evidence of considerable economic restructuring. A large share of new business creation has occurred in the industries most exposed to the pandemic downturn, primarily face-to-face services like restaurants. Other new business activity, such as online retail and data services, reflect new opportunities in the transition to a more remote environment. This report also traces the employment implications of this churn to uncover the impacts of initial employment losses and recent recovery across businesses of varying sizes. While questions remain around the contribution of these new dynamics to job creation and productivity, the persistence of these shifts and the resiliency of small businesses will play key roles in determining the path of the recovery moving forward.

Business Survival

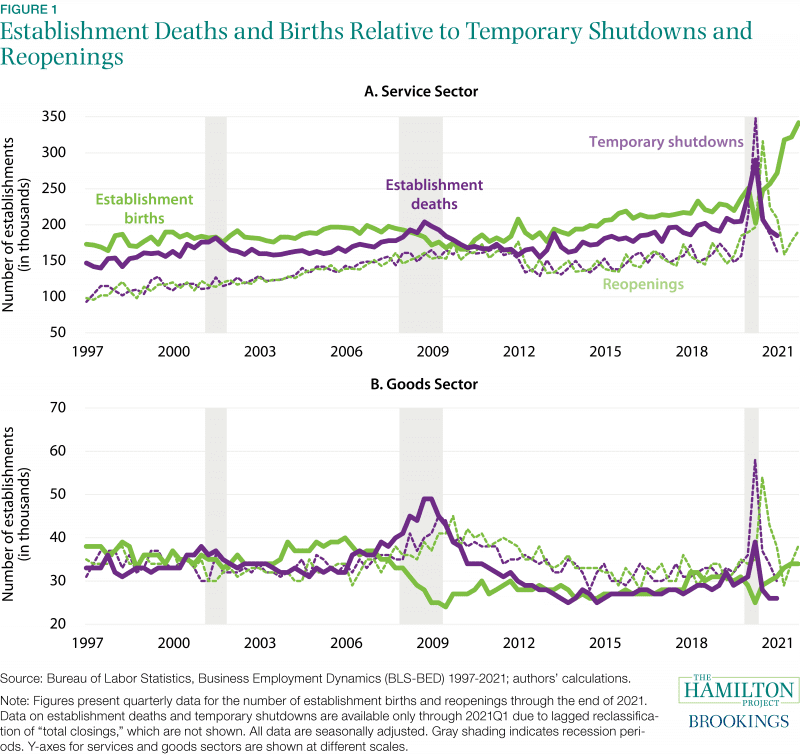

While an unprecedented number of businesses shut down amid early COVID lockdowns, new data suggest that a surprising majority of those businesses were eventually able to reopen. This was largely due to the abrupt nature of the downturn and reopening of the economy, and in part to the fiscal support that sustained household spending. Unlike past recessions, business exits were concentrated in the service sector, accounting for almost 90 percent of total exits through March of 2021. And certain industries bore the brunt of those impacts, with businesses in leisure and hospitality as well as education and health services experiencing nearly 70 percent more establishment exits in the first half of 2020 than through mid-2019.

New Business Creation

Applications for new businesses began to surge in early 2020, a trend consistent with the link between entrepreneurship and unemployment during economic downturns. However, through 2021, those applications had translated to near-record levels of new business creation. Patterns of new entrepreneurship suggest considerable economic restructuring induced by the pandemic. Many sectors seeing new business activity are similar to areas where existing businesses experienced severe declines in revenue and elevated establishment exits in 2020, including restaurants and personal services. Other new businesses, including in online retail and data services, reflect new opportunities in the transition to a more remote environment

Employment Impact

While labor markets were initially jolted by the early wave of business closures, 86 percent of jobs lost in the second quarter of 2020 stemmed from contractions among businesses that remained open. Those payroll contractions were mainly driven by larger firms with over 50 employees. In fact, the largest firms have been slower to recover their prior employment levels, ending 2021 having recovered 71 percent of prior levels compared to 96 percent for smaller firms. In total through 2021, BED data suggest that nearly 450,000 more establishments had opened than closed since the beginning of 2020, and that these new businesses had contributed a net 500,000 jobs to the recovery. In particular, new business creation has been a key driver of the employment recovery, where new establishment births created an average of 1 million new jobs in each of the final three quarters of 2021. While the report reveals strong momentum in the business sector, future job creation and productivity growth will depend on the persistence of pandemic-related work and lifestyle shifts and the ability of these new businesses to remain viable