Recession Remedies Home

Abstract

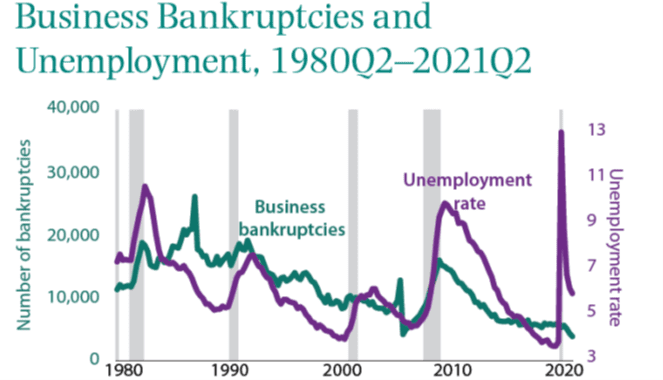

The authors survey the new federal subsidies and loans provided to businesses in the first year of the pandemic—including the Paycheck Protection Program (PPP), the Economic Injury Disaster Loan (EIDL) program, and aid targeted at specific industries such as airlines and restaurants—and also examine the additional lending and corporate bond purchases by the Federal Reserve. They observe that businesses overall fared much better during the pandemic recession and recovery than had been expected at the outset. In sharp contrast to past recessions, for instance, business bankruptcies fell during the pandemic. Many large firms continued to have access to private credit markets. They conclude that policies to support small businesses could have achieved their objective at a much lower cost to the federal government had the programs been more targeted. They find no credible evidence that the largest PPP loans had any substantial positive effect on employment. Loans through the EIDL program, which unlike the PPP loans were not forgivable, were better targeted. The Federal Reserve’s support for bank lending to business had little direct impact, in large part because banks were in much better shape than they were during the Great Recession. However, the Fed’s interventions in the corporate bond market had an important stabilizing effect in the early months of the pandemic in 2020. The authors caution policymakers against blindly deploying the 2020 tool kit, judging that the resiliency of the business sector reflects the unusual nature of the lockdown and reopening, and the substantial fiscal aid to households, more than it does the aid targeted directly at businesses. They also question the wisdom of providing federal aid to some large firms, such as airlines, that have a history of successful bankruptcy resolution.