Abstract

While social insurance programs help to buffer the effects of economic downturns, these programs have many gaps in coverage. In the face of income losses and unexpected expenses, households are not able to quickly adjust housing consumption. Homeowners cannot immediately sell homes and face large transaction costs in refinancing and modifying mortgages. While renters are more mobile, they typically hold leases that commit them to paying rent over a full year. Furthermore, low-income housing production programs in the United States tend to be pro-cyclical.

This paper proposes a set of policy reforms that would add automatic stabilizers to federal housing programs, helping both renters and homeowners stay in their homes during economic downturns and ensuring continued support for the construction and renovation of affordable housing. Specifically, we propose creating new emergency rental assistance accounts for low-income households to address the income and financial shocks that can trigger housing instability; an automatic homeownership stabilization program, consisting of a three-month forbearance period for vulnerable mortgage borrowers in response to a triggering event of elevated local unemployment; and a permanent tax credit exchange program that allows states to exchange tax credits for direct subsidies at a fiscally neutral price when demand from tax credit investors falls. We discuss several design and implementation questions, and acknowledge limitations. Nevertheless, and despite these limitations, these proposals would go a long way toward stabilizing households and housing markets during the next crisis.

Introduction

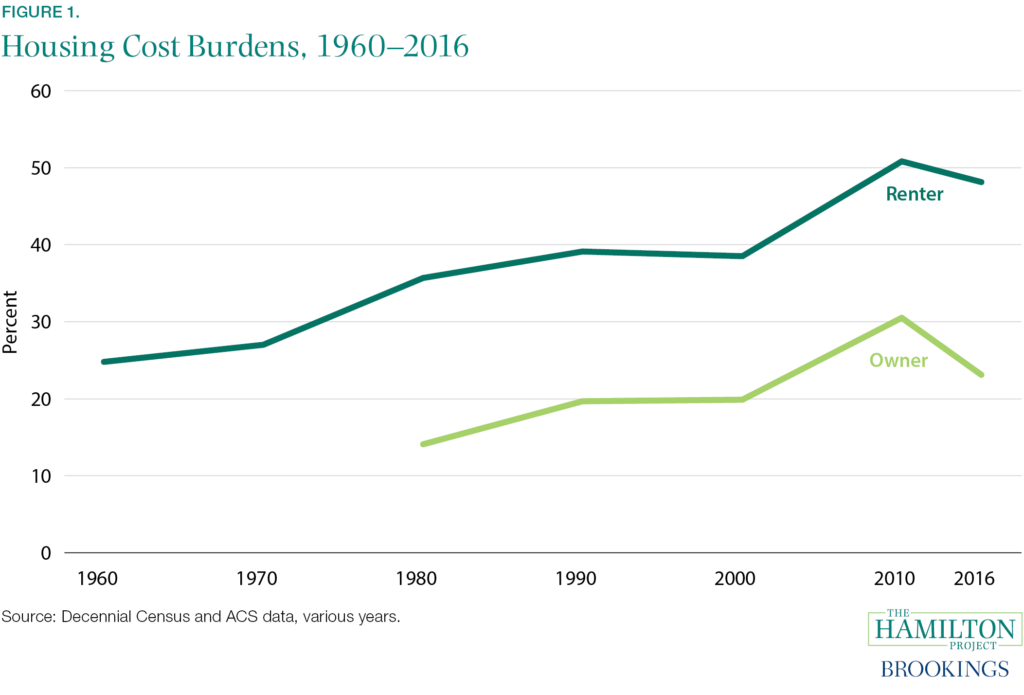

Most of the research and policy discussion around housing concerns long-term affordability. This focus is understandable. Housing costs account for a far more significant part of a household’s budget today than they did even a few decades ago. In 1960, just one in four renters in the United States and in 1980, just one in seven homeowners paid more than 30 percent of their income on housing costs (the standard measure of housing cost burden). By 2016 nearly half of renters and a quarter of homeowners were housing cost burdened (see figure 1). These shares are down slightly from their peak following the Great Recession, but they remain far higher than they were in the past century. Cost burdens have not only risen in New York, San Francisco and other coastal, high-cost metro areas; the share of renters burdened by housing costs has also risen by more than 13 percentage points between 1970 and 2016 in every one of the 50 largest metropolitan areas (Ellen, Lubell, Willis 2021).

But the focus on long-term affordability misses another critical challenge for housing policy: the occurrence of cyclical (and idiosyncratic) shocks to income and expenses that strain households’ short-term budgets and their ability to cover housing costs. In other words, many households who can afford their homes over the long run could face individual months when they are unable to afford them. To be sure, long-run and short-term affordability are related. The secular decline in affordability makes it more difficult for households to accumulate savings and makes covering monthly housing bills more onerous. Few households have the savings needed to easily smooth consumption through income or financial shocks. The Federal Reserve’s Survey of Household Economics and Decisionmaking (SHED) asks respondents whether they would be able to cover three months of expenses by borrowing money, using savings, selling assets, or borrowing from friends and family. As shown in figure 2, the share of respondents saying they would not be able to cover three months of expenses using all available sources was nearly a third in 2014, and fell only slightly to 29 percent in 2019. With such limited resources, even small shocks to income or expenses can put households at risk of eviction, foreclosure, or other involuntary moves.

Unfortunately, such shocks are common. McKernan et al. (2016) analyze data from the Survey of Income and Program Participation (SIPP) and find that, during 2012, about one in four families suffered some type of income disruption such as job loss, a health-related work limitation, or an income drop of at least 50 percent. Low-income families appear to be more vulnerable to income declines. More than a fifth of low-income families experienced a drop in income of 50 percent or more over a four month period, compared with 15.8 percent of middle-income and 15.9 percent of higher-income families. Using data on financial transactions from JPMorgan Chase from 2012 to 2015, Farrell and Greig (2016) also report substantial volatility and find that the lowest earners experienced the most volatility in their income. Looking over time, Dynan, Elmendorf, and Sichel (2012) find that household income volatility grew between the early 1970s and the late 2000s, with the share of households experiencing an income decline of at least 50 percent over a two-year period rising from about 7 percent in the early 1970s to more than 12 percent in the early 2000s.

Income declines are of course even more pronounced during economic downturns like the one we are currently experiencing. As shown in figure 3, the unemployment rate in the United States rose to 14.7 percent in April 2020, and although it fell in the subsequent months, it remained at 6.2 percent in February 2021, substantially elevated above the less than 4 percent unemployment rate seen throughout 2019. Unemployment rates were far higher for Black and Hispanic populations: as of February 2021, the unemployment rates for Black and Hispanic adults were 9.9 and 8.5 percent, respectively, compared to 5.6 and 5.1 percent for white and Asian adults.

Expense or financial shocks are even more common than unemployment spells or income shocks. According to Pew’s Survey of American Family Finances, 60 percent of households had experienced a financial shock—such as unexpected home maintenance, car repairs, or medical expenses— in the past year (Pew Charitable Trusts 2015). For the median household earning less than $25,000, these shocks amounted to about a month of income, compared to 10 days of income for households earning more than $85,000. And these financial shocks appear to have serious consequences. About two-thirds of low-income households facing financial shocks also experienced financial shortfalls over the year, such as missing a housing payment or other bill.

One of the expenses many households are unable to cover is housing payments. According to the American Housing Survey (AHS), 7 percent of renters were unable to pay their full rent in 2017, and cost-burdened renters were nearly twice as likely to report being unable to pay their full rent. More than 800,000 renters reported being threatened with an eviction in just the three months prior to the survey date, suggesting that as many as 3 million were threatened with an eviction over the course of that year. And this distress was during 2017, when the economy was relatively strong. Between December 9 and 21, 2020, 19 percent of renter households responding to the Census Pulse Survey reported being behind on their rent payments.

Homeowners face instability too, though not as many of them. In 2017 6 percent of homeowners with mortgages who responded to the AHS reported being somewhat or very likely to be forced out of a home within two months due to a foreclosure. Figure 4 shows the time series of loans in serious delinquency (90 days or more) and foreclosure from 2000 through 2020. This figure highlights the dramatic increase in homeowner distress and foreclosure during the housing boom and bust, the post-crisis recovery period, and the recent spike in defaults during the COVID-19 pandemic. While foreclosures did not rise as much as many feared they would during 2020 (thanks to the policy responses discussed below), the December Census Pulse Survey suggests that 11 percent of homeowners with mortgages were behind on their mortgage payments.

Unfortunately, these evictions and foreclosures carry collateral consequences; for instance, they make it more difficult for people to obtain new homes and even new jobs. Housing instability can depress earnings, undermine health, and worsen credit (Collinson et al. 2021). Furthermore, during downturns, such housing stresses can have systemic effects. Finally, evictions and foreclosures have a racially disparate toll. Eviction and foreclosure risks appear to be heightened for households of color. Consider that, of the 806,000 renters who reported being threatened with an eviction in the past three months in the 2017 AHS, 39 percent were Black (and no other race), while only 21 percent of surveyed renters were Black (and no other race). Regarding foreclosures, research by Houghwout et al. (2020) finds sharply higher foreclosure rates in predominantly Black and Hispanic ZIP codes, especially during the Great Recession; those high rates have persisted thereafter.

While many social insurance programs in the United States are countercyclical, with support automatically rising with demand, housing programs are not. We make the case for three sets of policy reforms that would help to automatically stabilize the housing market during downturns, permitting renters and homeowners to stay in their homes, and allowing the construction and renovation of affordable housing to continue during downturns.

Background: Justifications for Intervention

Unemployment insurance and other social insurance programs are critical in helping to buffer the effect of economic downturns. But these programs have many gaps in coverage: they fail to cover everyone and fail to protect against many common shocks such as lost hours at work, the dissolution of a relationship, or an emergency expense, which are often triggers to housing instability. When people face income losses or unexpected expenses, they can cut back on much of their consumption. But households are not able to quickly adjust housing consumption. Renters typically hold leases that commit them to paying rent over a full year. Even if they are able to get out of their lease, they face high transaction costs in finding and moving to a new home. Transaction costs for homeowners are even higher. Selling and buying homes are lengthy and costly processes. Furthermore, homeowners face substantial frictions in refinancing or modifying their mortgages or in requesting forbearance from their lender.

Growing evidence shows that housing instability is costly to individual families, neighborhoods, and even the overall economy. Most housing instability stems from economic distress. This fact makes it difficult to disentangle the role of unstable housing from adverse events that typically trigger it. Two recent studies shed new light on the effects of eviction and foreclosure on the outcomes of individuals and families facing such hardship. Collinson et al. (2021) link housing court records from two major urban centers to administrative data and use a quasi-experimental research design leveraging the random assignment of eviction cases to judges to study the causal consequences of eviction. They find that although eviction is preceded by a variety of markers of economic distress—including falling earnings and employment, and rising unpaid bills—eviction itself also contributes to lower earnings, reduced access to credit, increased hospital visits, and a spike in homeless shelter use in the two years following a case.

Related work by Diamond, Guren, and Tan (2020) uses a similar research design examines the effects of foreclosure on residential mobility, financial and household strain for homeowners, renters that are foreclosed upon, and landlords. For homeowners, those authors find that foreclosure increases divorces, financial strain, and moves to lower-income neighborhoods. There is also evidence that foreclosure may contribute to adverse health events and undermine children’s educational progress (Been et al. 2011; Currie and Tekin 2015). These papers suggest substantial costs to individuals and families from losing their homes.

Beyond the direct effects on individuals and families, housing instability can also generate spillover effects on the surrounding community. A number of studies have explored the effects of foreclosures on the nearby properties and the surrounding neighborhood. This work finds that concentrated foreclosure increases neighborhood crime (Ellen et al. 2013) and lowers the value of nearby property (Anenberg and Kung 2014; Campbell, Giglio, and Pathak 2011; Gerardi et al. 2015).

Finally, acute housing instability such as eviction or foreclosure can generate a sizable fiscal externality borne by local governments. Increases in homelessness as a result of eviction or foreclosure can be quite costly for local communities, and can lead to increased expenditures on homeless shelters, emergency medical care, criminal justice, and potentially elementary and middle schools that are strained by student mobility. Additionally, reduced rental revenues and foreclosures can depress housing values and the local property tax base, making it more difficult for communities to finance basic public services.

The housing market’s enormous size and interconnectedness with so many segments of the economy, including financial markets and real construction activity, have led some macroeconomists to conclude that the housing sector is the critical driver of the business cycle (e.g., Leamer 2015). The mass foreclosure episode of the Great Recession revealed weaknesses in the financial system when opaque credit losses in mortgage-backed securities triggered the near collapse of the banking system and a global recession. In short, the highly levered housing sector poses a systemic risk to the macroeconomy.

Addressing this systemic risk requires further government intervention in a market already heavily influenced by federal participants. During the Great Recession, the federal government covered losses suffered by Fannie Mae, Freddie Mac, and the Federal Housing Administration (FHA), in addition to other financial institutions, in part because of limited options for dealing with large volumes of distressed borrowers and an inability to systematically prevent widespread default-price spirals. The costs to taxpayers were enormous (on the order of $370 billion, according to Lucas 2019), so finding automatic approaches to avoid or attenuate further housing crises would reduce taxpayer exposure.

Challenge: Inadequacy of Current Policies

Unfortunately, our current suite of housing policies is simply not up to the task of addressing housing insecurity and its follow-on costs. Below we explain how low-income rental assistance, support for homeowners, and affordable housing production programs all fall short in stabilizing households and markets during economic downturns.

Low-Income Renters

Much federal housing support for low-income renters is devoted to long-term subsidy programs that provide recurring assistance to participants through programs such as housing choice vouchers, public housing, and project-based rental assistance. These programs serve only a small fraction of the eligible households—typically around one in four—and are massively oversubscribed. Since these programs are not entitlements, their expansion or contraction depends not on changing needs or macroeconomic conditions, but rather on the whims of discretionary federal spending. As a result, nominal spending on rental assistance has remained essentially flat for the past 18 years, despite large swings in the national economy (see figure 5).

While real rents tend to stagnate or fall in periods of economic downturn, this softening rarely offsets the impact of lost wages, unemployment, or rising poverty, leaving demand for housing assistance elevated during recessions (Lens 2018). Moreover, as the economy weakens fewer households exit the major housing programs voluntarily, resulting in fewer new vouchers being issued or subsidized units becoming available. This pattern, coupled with stagnant per capita spending, means that housing assistance is typically scarcer during a recession than in periods of greater economic prosperity. By contrast, other parts of the safety net strengthen during recessions, such as the Supplemental Nutrition Assistance Program (SNAP), which grows or contracts in response to local economic conditions (Ganong and Liebman 2018); or unemployment insurance, which automatically expands when joblessness rises (see figure 5).

The current system of administering housing assistance is not responsive to changing macroeconomic needs, and it is also not designed well to adjust to changing individual circumstances. Individuals and families facing acute needs often must wait years to get an offer of federal housing assistance. Therefore, the timing of when households actually receive assistance rarely lines up with the period when assistance is needed most. Forcing prospective clients to endure long waits could lead some applicants to drop off waiting lists because they are unable to maintain contact with a housing authority. The prospect of multiyear waits might deter those with the most immediate need for housing from applying for assistance altogether.

For households already receiving housing assistance, programs are theoretically set up to increase the aid provided to such households when they encounter economic setbacks. Rent rules for vouchers, public housing, and project-based rental assistance programs all tie the amount of subsidy a family receives to their most recently certified income. This means that, if a household experiences a meaningful loss of income, they can recertify their income with their housing authority, and reduce the size of their required rent contribution (thereby increasing their housing subsidy). Additionally, for individuals lucky enough to be issued a voucher, it may be easier to find a landlord willing to lease to them during an economic downturn, when vacancy rates are typically higher (Finkel and Buron 2001).

Although the current system of administering the major rental assistance programs is not tailored to address individual-level shocks, the federal government does attempt to provide some housing assistance for vulnerable individuals and families experiencing economic insecurity, assistance that responds to more-urgent needs. The Emergency Solutions Grant (ESG) program, which is part of the larger suite of block grants that the US Department of Housing and Urban Development (HUD) uses to address homelessness, provides funds to local communities to support rapid rehousing programs as well as the operations of emergency shelters. The ESG is a relatively small block grant, however, and local communities must divide it across several important uses: emergency shelter operation, homelessness prevention, rapid rehousing, street outreach, and management of homeless information systems.

Due to funding constraints, the availability of emergency assistance for clients applying for such assistance often fluctuates dramatically over time (Evans, Sullivan, and Wallskog 2016). The ESG program could be expanded to cover a wider segment of vulnerable renters. The CARES (Coronavirus Aid, Relief, and Economic Security) Act allocated $4 billion for the ESG program to prevent housing instability and homelessness during the early stages of the pandemic. As a part of this allocation, HUD waived or altered existing program requirements for ESG such as lifting the income eligibility from 30 percent to 50 percent of the area median income (AMI) and expanded the allowable length of rapid rehousing assistance.

Homeowners

Homeowners experiencing an income shock confront the same challenges with making regular mortgage payments as renters. However, homeowners face a different set of incentives for maintaining housing stability relative to renters. Unlike renters, homeowners have a long-term obligation, often consisting of a 30-year fully amortizing mortgage that they are paying off gradually. They may also have equity built up in their homes, as the difference between the home value and the outstanding mortgage often represents many families’ largest asset. This long-term commitment, combined with the incentive to protect equity in their homes, makes it essential for homeowners to find ways to continue making payments and avoid foreclosure (or forced sale) in the midst of a temporary disruption to household income.

Homeowners also face a different institutional context when they encounter difficulties with making their mortgage payments. Rather than interacting directly with a landlord, homeowners instead interact with mortgage servicers as intermediary representatives. These servicers sometimes have discretion over temporary payment leniency or more permanent modifications, but are often constrained and incentivized by the contractual relationship (called a pooling and servicing agreement, or PSA) between the servicer and the financial entity that holds the mortgage. These agreements often limit renegotiation options for borrowers and set forth strict timelines for initiating foreclosure proceedings. In addition to federal policy and guidelines, the rules of foreclosure also depend crucially on state laws regarding the judicial process.

The experience of the Great Recession revealed enormous failures of both policy and imagination; few expected that house prices would fall nationwide, overwhelming servicer capacity for workouts and triggering a wave of foreclosures. Prior to the Great Recession, there were no programs of a meaningful size to protect homeowners who fell behind on payments (Amromin, Bhutta, and Keys 2020). Instead, distressed homeowners had to seek payment adjustments on their own in a one-off renegotiation with their servicer.

Servicers most commonly can provide some form of forbearance, which allows a borrower to pause or reduce payments temporarily. In some instances, servicers can offer a temporary or permanent modification to features of the mortgage contract, such as reducing the interest rate or extending the loan term.

Homeowners thus had to engage in idiosyncratic workout arrangements, each negotiated separately. Many servicers refrained from offering generous workouts, or homeowners were not aware of their options, and foreclosure rates rose between 2005 and 2007, and then spiked in 2010 (see figure 4).

The federal government plays an outsized role in the mortgage market in the United States even in good times, but during periods of distress government programs played a crucial role in keeping families in their homes. The Home Affordable Modification Program (HAMP) was set up in 2009 to expand and standardize modifications for homeowners experiencing financial hardship. The program reduced borrowers’ payments and provided substantial financial incentives to encourage renegotiation. As shown by Agarwal et al. (2017), while the program indeed prevented a sizable number of foreclosures, enrolling more than 1 million homeowners into permanent modifications, its overall effectiveness (intended to help 3 million to 4 million homeowners) was hampered by servicer-specific capacity issues and general reluctance to fully participate in this voluntary program. The parameters of the program were relaxed in 2012 to broaden the set of renegotiations considered to have positive net present value from the perspective of the servicers, but by this point the foreclosure wave had already crested, with devastating results.

In addition to being dependent on the capacity and inclination of servicers, the program was only available to owner-occupied properties, neglecting small landlords. HAMP was also only an option for homeowners with a mortgage owned by Fannie Mae or Freddie Mac, leaving roughly one-third of all homeowners excluded from federal modification assistance. An additional limitation of the program was the focus on permanent modification to a temporary problem, including in some cases the writing down of the principal balance outstanding on the mortgage (discussed in more detail below).

On homeownership, the swift and near-universal COVID response represents the smart implementation of lessons learned from the Great Recession. Rather than setting up a complex voluntary program that was too slow and too limited to prevent millions of foreclosures, the FHA, Veterans Affairs (VA), Fannie Mae, and Freddie Mac quickly rolled out a forbearance program that paused payments and froze foreclosure proceedings among these federally backed loans. The program was timely, generous, and widespread, providing an initial forbearance of up to 180 days with the possibility of extending for another 180. Servicers have been directed to report to the credit bureaus that loans that were current prior to the forbearance period continue to report loans as current, preventing any harm to borrowers’ credit scores. The government mortgage providers have largely given consistent guidance and have adjusted their timelines, extending forbearance lengths and foreclosure moratoria to align with the duration of the COVID crisis thus far.

In all, COVID relief for homeowners provided by government mortgage agencies has been a success. Forbearance programs expanded sharply at the onset of the COVID pandemic, peaking at 8.5 percent of all outstanding mortgages in June, gradually declining to 5.5 percent of all mortgages in December (DeSantis 2020, ibid 2020). Some questions remain regarding whether the relief will continue until the economy is fully recovered, and what form repayment will take when forbearance expires.

The relief has been incomplete for the mortgage market on two critical dimensions, however. First, the relief helps only those borrowers with federally backed loans. As discussed by Kaul (2020), roughly 3 million mortgage loans that are not federally backed are held in either bank portfolios or private-label securities. In the absence of access to federal COVID relief, these borrowers must renegotiate with their servicers, who are again constrained by capacity and the requirements of their pooling and servicing agreements. These agreements may provide servicers with only limited discretion or guidance for enacting large-scale forbearance, as during the Great Recession. While reportedly the private market has improved the design of these agreements, receiving relief during COVID remains an idiosyncratic process for these borrowers with privately held loans, although the borrowers are not at fault for the lack of standardized procedure.

Second, and importantly for our context, receiving COVID relief requires action on the part of the mortgage borrower, who must actively request forbearance from their servicer. As of September 28, 2020, an estimated 400,000 mortgage borrowers were “needlessly delinquent”—meaning they were eligible for COVID-related relief but were not receiving it because enrollment requires active participation (Neal and Goodman 2020). The Urban Institute’s examination of Ginnie Mae data (which covers FHA/VA loans) of loans that were current in March 2020 but at least 30 days delinquent by July 2020 found no observable mortgage contract characteristics that predicted which homeowners were failing to respond to generous federal relief offers and repeated outreach (Neal and Goodman 2020).

While forbearance has been widely available to mortgage borrowers, survey evidence suggests that a substantial fraction of borrowers remain confused about both eligibility requirements and the benefits of forbearance. Analyzing the January 2021 COVID-19 Survey of Consumers conducted by the Federal Reserve Bank of Philadelphia’s Consumer Finance Institute, Lambie-Hanson, Vickery, and Akana (2021) find that 17 percent of those surveyed who did not use forbearance may have needed forbearance but did not understand how to apply for it or how it would affect their total payment due, their credit records, or their payment schedule. A lack of understanding, combined with the necessity of action on the part of the borrower, has represented a substantial barrier to take-up for many struggling homeowners.

This failure to take up generous mortgage relief benefits parallels findings in other settings, including mortgage refinancing opportunities. During downturns, monetary policy creates a valuable option for homeowners to refinance at lower mortgage interest rates (see, e.g., Beraja et al. 2019; Berger et al. 2020; Bhutta and Keys 2016). Refinancing requires substantial effort on the part of homeowners, however, and many do not qualify during a downturn because of income, credit score, or home value re-underwriting (DeFusco and Mondragon 2020). Additional studies have found support for behavioral explanations of failing to refinance, including issues related to misinformation, lack of trust, inattention, and inertia (Andersen et al. 2020; Johnson, Meier, and Toubia 2019; Keys, Pope, and Pope 2016).

An alternative approach to temporary homeowners’ assistance was explored in the Great Recession when the US Treasury created the Hardest Hit Fund (HHF) in February 2010. The HHF targeted homeowners who had experienced an employment or income shock and offered temporary payment assistance directly to servicers until the homeowner was reemployed, or had exhausted available benefits. Participation in the program required homeowners to actively apply for assistance and required servicers to actively cooperate. Moulton et al. (2020) provide the first evaluation of the HHF, and find that the program spent nearly $7 billion on direct assistance to struggling homeowners, and that it sharply reduced the rate of foreclosures and produced a net social benefit of $2 billion (not incorporating the spillover effects on the prices of nearby properties, which could be substantial). The program appears to be a significant success story; it provided targeted support to the population that needed it at the time in order to avoid the worst outcome, but nonetheless it required substantial outlays and active decision-making on the part of both homeowners and servicers.

In sum, the past two recessions have seen significant expansions of stabilizing programs for homeowners, who can now receive federal support, renegotiate independently with servicers, or exercise refinance options. These programs, especially at the federal level, have been expanded during the COVID crisis, although there is uncertainty about what will happen when foreclosure moratoria and forbearance programs run out, and what types of modifications will be available for homeowners.

Crucially, all this support requires action on the part of policymakers to develop and administer programs in the midst of a crisis, and requires action on the part of homeowners to either reach out to servicers in order to arrange for relief or to contact mortgage providers to initiate a refinancing of their mortgage. Furthermore, this support is not universally available to all mortgage borrowers, many of whom are unaware of whether their mortgage loan is federally backed. These limitations and active requirements create meaningful delays in provision and problematic gaps in support.

Production and Preservation of Low-Income Housing

As unemployment rates rise and incomes fall, the need for affordable housing naturally grows, and so does the need for the jobs that housing production and renovation create. Yet, if anything, our current affordable housing programs provide less support for the production and renovation of affordable housing during downturns. The private credit market, which affordable housing developers rely on for credit, typically tightens underwriting and cuts back on lending during downturns. And the Low-Income Housing Tax Credit (LIHTC), the primary source of public subsidy for producing and preserving affordable housing, also tends to be pro-cyclical.

Enacted as part of the Tax Reform Act of 1986, LIHTC supports the construction or rehabilitation of more than 100,000 units every year (HUD 2020). The federal government issues tax credits to states, who then allocate them to developers of affordable housing projects. Developers typically sell tax credits to corporate investors, which reduces the amount of debt their projects need to support and allows them to charge lower rents. Unfortunately, during downturns, when those corporate investors anticipate less taxable income and therefore less ability to use tax credits, demand for tax credits falls.

Indeed, during the Great Recession the price of tax credits plummeted to about $0.60 per dollar of tax credits, creating significant gaps in funding for thousands of projects that had unsold tax credit allocations and had counted on a price of about $0.90 per dollar (Joint Center for Housing Studies 2009). Tighter underwriting and reduced lending on the part of private lenders further amplified the subsidy shortfalls.

The vulnerability of the tax credit is arguably compounded by the fact that the investor base is narrow. While individual taxpayers and privately owned businesses can technically purchase credits, they rarely do so, in part because of the long duration of tax credits and rules that make it difficult for them to make full use of those credits to offset their tax liability. Perhaps more importantly, tax credit yields are low, since lending institutions have an incentive to pay high prices for tax credits as a way to boost their Community Reinvestment Act of 1977 grades. Other businesses are simply not willing or able to pay the same prices. In recent years, more than 80 percent of LIHTC purchases have been from banks (73 percent in 2016–18) and the government-sponsored enterprises (GSEs) (7 percent) (CohnReznick 2019). Strong demand from large financial institutions has meant more subsidy dollars for qualifying projects, but it has also led to a narrowing of the base of investors, leaving the credit vulnerable to fluctuations in demand from financial institutions. Furthermore, demand is regionally uneven, with areas without large banks concerned about their Community Reinvestment Act rating seeing far less demand and lower prices. Notably, demand has remained relatively stable during the current downturn, since financial institutions (at least to date) have not seen the same losses that they did during the Great Recession.

Congress has taken some important steps to help ensure that the tax credit continues to be attractive during downturns. First, during the Great Recession, Congress launched the Tax Credit Exchange Program, which temporarily allowed state allocating agencies to swap unused or returned 9 percent tax credits for a grant from the federal government. The Tax Credit Exchange Program provided support to 911 LIHTC developments with more than 70,000 units during this period (Scally et al. 2018). State allocating agencies received $0.85 for every dollar of tax credit they exchanged, a price deemed to be fiscally neutral for the federal government. Because the program was designed to make up for the exit of the GSEs from the tax credit market, every allocating agency was allowed to swap up to 40 percent of their 2009 allocation, which was the average GSE market share at the time. Second, Congress established minimum tax credit rates for both the 9 percent tax credit (through the Housing and Economic Recovery Act of 2008) and the 4 percent tax credit (through the recent COVID relief bill) rather than letting them float with interest rates and becoming less valuable as interest rates fall.

While these actions have been helpful, LIHTC is still vulnerable to reductions in both credit supply and investor demand. Evidence suggests that the Tax Credit Exchange Program was helpful in keeping the production pipeline going during the Great Recession, but it was only temporary and required congressional action. There is no mechanism in place to allow such exchanges in the next downturn that hits the financial sector.

Finally, another issue is the debt side of the multifamily market. Developers depend on mortgage loans to complete developments, but during downturns, lenders tend to tighten underwriting and cut back on lending, and investors withdraw from private label mortgage-backed securities. During the 2008–2009 financial crisis, the GSE share of the multifamily market rose to approximately 70 percent of debt, up from about 35 percent during the early 2000s. The increase in GSE share resulted largely from private sources pulling back, not because the GSEs invested more (Kaul 2015). The continued purchase of multifamily loans by the GSEs helped to keep some construction going.

Since the housing crisis, the Federal Housing Finance Agency (FHFA) has established caps that limit the ability of GSEs to purchase multifamily loans and fill credit gaps when private lenders and investors withdraw. From 2015 through 2018, the annual caps were set at a flat $30 billion or $35 billion per GSE, which would have been binding but for an exception for green loans (i.e., loans that support energy and water efficiency improvements). The carve-outs for green loans permitted the GSEs to collectively purchase more than $140 billion worth of loans in 2018, well above their joint $70 billion official cap. The FHFA lifted each GSE’s cap to $100 billion for the five quarters starting in October of 2019 ($80 billion on an annualized basis), but it eliminated exceptions and mandated that more than a third of multifamily purchases be directed to affordable housing (Ackerman 2019). The FHFA recently lowered caps slightly to $70 billion per GSE for 2021 and required that half of the loans support affordable housing, which should drive more credit to LIHTC deals. While it is difficult to assess the degree to which the caps have restricted GSE purchases in practice, they clearly have the potential to do so, depending on the dollar amount. Significantly, changes in the caps do not move automatically with the market but instead depend on the discretion of the FHFA director.

Proposal: Bolstering the Housing Safety Net

In this section we propose a set of three policy reforms to make housing support more countercyclical. We propose (1) emergency rental assistance accounts that would provide renters with a buffer to help them manage both systemic and idiosyncratic shocks, (2) an automatic homeownership stabilization program for low- and moderate-income homeowners, and (3) an automatic tax credit exchange program that would allow allocating agencies to convert LIHTCs to direct subsidies when investor demand falls.

In order to maximize the countercyclicality of these automatic policy tools, we propose tying their activation to increases in local unemployment. Measures of metropolitan statistical area (MSA)–level unemployment are available for roughly 400 MSAs, and those residing outside of these MSAs could receive support based on nearest-MSA or state-level unemployment indices. Given that housing conditions vary greatly across regions, a one-size-fits-all approach based on a national trigger would, in our view, neglect many struggling communities even when aggregate metrics suggest that the economy is healthy.

Specifically, these programs could be tied to local unemployment using the threshold recommended by Sahm (2019). Using a three-month moving average of local unemployment rates, these policy tools would be activated when unemployment rises by 0.5 percentage points above the past 12-month minimum. Figure 6 shows the Sahm threshold rule for the United States from 2000 to 2021, with time periods where the unemployment changes (relative to the prior year’s minimum) exceed 0.5 percentage points as those where these programs would automatically spring to life. As Sahm (2019) shows, this threshold is an outstanding early indicator of subsequent macroeconomic contractions, predicting recessions in a fast, accurate, and transparent way.

Our proposal takes the Sahm threshold rule trigger from the national to the local level. Figure 7 shows the share of MSAs (out of nearly 400 that the BLS estimates monthly unemployment rates for) that would be above the Sahm threshold in any given month from 2000 to 2020. While the COVID crisis and the Great Recession plunged all US MSAs into recession based on this indicator, a notable aspect of this figure is that around the dot-com recession of the early 2000s, some MSAs never reached the recession threshold. On the other hand, some MSAs’ local economies struggle even when the national economy is no longer officially in recession, with more than 30 percent of MSAs above the threshold in 2003–4. Since these stabilizers are inherently focused on local housing markets, we believe it makes sense to pair the policies with locally oriented thresholds for action. We discuss some of the trade-offs of a local calculation of the triggering event below. Nonetheless, our analysis here suggests that focusing on local variation will direct support to those who need it most.

Emergency Rental Assistance Accounts

As described above, the current landscape of assistance options for low-income renters is largely inadequate to address either deteriorating macroeconomic conditions or idiosyncratic shocks that destabilize individual households. A more-reliable, more-responsive system of assistance to address the volatility in the financial circumstances of low-income renters is needed. To this end, we propose the creation of new emergency rental assistance accounts for individual tax units to address the broad range of negative shocks that can trigger acute housing instability such as eviction and resultant homelessness.

The accounts would be prepopulated by the US Treasury with a balance equal to four or five times the local Fair Market Rent at the time of account opening. The IRS would automatically create these accounts for any tax unit that is renting with an income less than 80 percent of the AMI. The size of the subsidized initial deposit would be determined by the size of the tax filing unit.

The emergency rental assistance account would be available to all renter households earning less than 80 percent of AMI.1 After an account is created for an eligible household, the household would continue to have access to the account as long as their annual income in any of the previous three tax years is below 80 percent of AMI. Unused funds in the account could be rolled into a down payment at any time if the household purchases a home.

Payments from the account would be required to go toward housing, to ensure that households (at a minimum) remain stably housed, as well as to enhance political feasibility. The tenant would enter details for their landlord, such as name, address, and other details such as tax identification number, into an IRS website. The tenant would then control when payments are made, and the amount to be dispersed. When the tenant requests a payment through the IRS website, the IRS would then mail a check to the listed landlord.

Importantly, households would not have to provide a reason for drawing from the account. This design feature would have a number of potential benefits. First, it would provide greater administrative simplicity. Second, it would ensure that vulnerable households can receive immediate assistance before their financial woes compound. Third, by not tying payments to a particular event, it would allow individuals to use assistance to address housing instability triggered by a wide variety of circumstances. To discourage tenants from aggressively drawing down the entirety of the account unrelated to an urgent need, the accounts would feature a saving incentive.

Limiting the accounts to a finite amount of assistance reflects a recognition that this tool is not a replacement for housing programs designed to address the problem of persistently low incomes (such as housing vouchers, public housing, or project-based rental assistance). The accounts are intended to provide a flexible buffer for low-income renters to keep them housed through periods of temporary difficulties. Previous research suggests that evictions are typically preceded by short-term drops in income (Collinson et al. 2021). And the available research suggests that even short-term rental assistance can achieve persistent reductions in homelessness when administered to clients before they lose their housing (Evans, Sullivan, and Wallskog 2016). Using a fixed amount for the account also limits concerns that some might have of strategic rent nonpayment.

It is not entirely clear from existing research how large the account balances should be to address the most common shocks to low-income households. Many households facing eviction owe between two and three months of back rent (Collinson et al. 2021; Desmond et al. 2013). Piloting the intervention could be quite informative to determine details including the size of the accounts and the savings incentive. A significant concern with the proposed structure is that periods of prolonged economic downturn could lead many households to exhaust their accounts. To address this, the account balances could be replenished when the local Sahm threshold rule is triggered.

This raises the concern that households would strategically withdraw all funds in anticipation of replenishment during a local economic downturn, however. An alternative to replenishing the account with fully subsidized payments once it has been exhausted is to convert the account to a source of zero-interest loans for households to borrow against through future tax refunds. For example, after the household has withdrawn all funds from their account, they could borrow an amount up to an additional four times their Fair Market Rent to make emergency housing payments, with any amount that the household borrows from the account applied to their future tax liability in subsequent tax years.

We do not expect the accounts to have a major effect on the overall rental market. Conceivably, the accounts could increase demand for housing, which could push up rents in markets with inelastic housing supply. The size of the subsidy and the fact that the amount is finite, however, leads us to expect only a small effect on overall demand for rental housing. Federal rental assistance—such as housing vouchers—offers a much larger ongoing subsidy, and vouchers have little impact on overall rents (Eriksen and Ross 2015). The accounts could impact landlord behavior on other margins such as tenant screening. For example, some landlords might be more willing to rent to tenants with volatile income, but landlords might also request information on account balances from prospective tenants. It is possible that by reducing nonpayment risk that the accounts could conceivably lower rents—particularly on units likely to be rented by tenants at high risk of nonpayment—by lowering costs to the landlord.

While this proposal is not feasible to stand up in response to the accumulated arrears from the COVID-19 economic crisis, creating a new structure to provide timely assistance to the housing insecure will ensure that the policy response to future crises is swifter and more effective.

Automatic Homeownership Stabilization Program

Similar to the purpose of the automatic program described above for renters, the primary goal of the automatic stabilizer program we propose for low- and moderate-income homeowners is to keep homeowners in their homes, reduce housing instability, and prevent negative spillovers from episodes of mass foreclosure. The program should be broad based, with eligibility for all mortgages for low- and moderate-income borrowers with household incomes below 100 percent of AMI in the pre-distress period (or at origination).2 The program should help households smooth negative shocks and minimize housing disruptions over the business cycle.

Relative to landlord-tenant relationships, the long-term duration of mortgages presents both a challenge and an opportunity. On the one hand, substantial short-term adjustments need to be provided in a timely and universal manner by an industry that is typically relatively slower moving. On the other hand, the length of the mortgage obligation provides ample time for temporarily paused or reduced payments to be made up, either as higher monthly payments thereafter or a longer loan term needed to fully pay off the debt.

The design of an automatic homeownership stabilization program (AHSP) should build on lessons learned from the successes and limitations of HAMP during the Great Recession and COVID-related housing relief. The main successful elements have been rapid deployment of forbearance, avoiding servicer discretion and capacity issues, and adjusting the generosity and parameters of the programs as necessary. The primary limitations have been the lack of universality, the lack of standardization of guidelines for private modifications, the need for active participation on the part of servicers, and the need for active responses on the part of borrowers, creating a group of needlessly delinquent homeowners.

In order to capture these elements of success and address these prior weaknesses, we propose that all mortgages eligible for the AHSP automatically enter a three-month forbearance period in response to a triggering event of elevated local unemployment. This forbearance would be “opt out” rather than “opt in” from the borrower’s perspective and be as automatic as a change to payments that occurs when an adjustable-rate mortgage resets: the servicer could simply send a letter one month in advance telling the borrower that no payment is due the following month.

Prior research has made clear that these stabilizers should be temporary to reflect temporary shocks, rather than to address the debt overhang of principal balances. Principal reductions have been shown to be far too costly and to deliver far less bang for the buck in terms of preventing default relative to reductions in monthly payments (Ganong and Noel 2020; Scharlemann and Shore 2016).

A standardized automatic initial forbearance period would give borrowers and servicers much needed breathing room to assess subsequent need for continued forbearance, further modification, or additional support. If combined with a streamlined refinancing or modification program (along the lines proposed in Golding et al. 2021), servicers would have the time to determine what changes to the mortgage contract, if any, are appropriate. The three-month forbearance period would also provide all parties with time to collect information regarding the severity and permanence of the downturn, and would guide subsequent adjustments accordingly.

This AHSP has many proposed policy antecedents, in particular echoing and amplifying the recommendation of Piskorski and Seru (2018), who propose the indexation of mortgage payments to local economic conditions. Our proposal is an easily implemented simplification based on forbearance and local unemployment rates, but exploring more-sophisticated stabilizers that incorporate indexation would be worthwhile. Eberly and Krishnamurthy (2014) provide a relevant theoretical framework and discuss the trade-offs between reductions in mortgage payments and principal write-downs, supporting the deferment or reduction of mortgage payments in a recession. Guren, Krishnamurthy, and McQuade (2020) build a quantitative equilibrium lifecycle model to examine alternative mortgage designs, and find that contracts that automatically embed countercyclical payments dramatically outperform modification options that spread relief when liquidity constraints are less likely to be binding. Three months of forbearance at precisely the point when the constraints are likely to be most acute would greatly reduce homeowner distress.

Importantly, Guren, Krishnamurthy, and McQuade (2020) find that the front-loading of relief to households sharply reduces the dynamic spiral between defaults and house prices. An extensive literature has documented substantial feedback effects from foreclosed properties on neighboring homes (e.g., Anenberg and Kung 2014; Campbell, Giglio, and Pathak 2011). Forestalling a tidal wave of foreclosures would benefit not only the neighborhoods where distress is frequently concentrated, but also any potential ripple effects faced by the broader financial system (Greenwald, Landvoigt, and Van Nieuwerburgh 2021). A thorough cost-benefit analysis would need to incorporate these dynamic effects to fully assess the value of automatic countercyclical support for the housing market.

A natural concern for introducing an automatic forbearance rule into mortgage contracts is that this clause may affect the profitability of the contract for investors. Given the discussion above, the net social effect is likely positive since the temporary pause in payments for a large number of borrowers would be offset by the reduction in the severity of recessions and the probability of a wave of foreclosures that starts a downward spiral in house prices. In addition, this policy would finally remove the need for active behavior on the part of homeowners, who are often difficult for servicers to contact when they fall behind on payments. It is ambiguous what the overall financial consequences would be, but we expect that equilibrium mortgage rates would not increase very much once accounting for the total proposed benefits, and would recommend that these costs be borne by a broader pool of homeowners than just the low- and moderate-income borrowers who receive the benefits.

A related concern with increased use of forbearance would be the burden faced by mortgage servicers, who generally have to forward payments to investors even if the borrower is in forbearance (Kim et al. 2018). During COVID, the Mortgage Bankers Association and a number of other trade groups have advocated for the creation of a federal liquidity facility to support mortgage servicers as they forward missed payments to investors. Since there is an increasing share of non-banks active in lending and servicing in the mortgage market, we believe a public-private liquidity facility, combining a line of government credit with a fund contributed to in good times by originators and servicers, would provide an additional level of stability in the mortgage finance system and allow servicers to be confident that they can continue to meet their full obligations to investors when briefly pausing borrowers’ payments in a downturn.

Given the potential benefits for a policy of this type, we recommend that a government agency, which already bears the bulk of the loans’ default risk, experiment with contract features such as introducing an automatic stabilizer program to newly originated or existing mortgages. Investors in government-backed securities are concerned only with prepayment risk and should not be particularly harmed by this program, since these stabilizers would presumably have much larger effects on default risk. The sizable government-backed mortgage market represents a largely untapped laboratory for experimentation. We encourage the agencies operating in this market to innovate on new ways to provide automatic temporary relief for distressed borrowers, and test the efficacy of these innovations through controlled experimental settings. During the pandemic, all federal student loans and federal disaster loans have been automatically placed into forbearance without needing action from borrowers; a system should be in place to do the same for federally backed mortgages.

Automatic Tax Credit Exchange Program

As noted above, our system of support for low-income housing production and renovation fails to expand as needs grow; indeed, both loans and subsidies available through the LIHTC may actually decline as credit tightens and investor demand dries up. We recommend two key reforms to boost—or at least sustain—construction and preservation of affordable housing during downturns.

The first recommendation is to make the LIHTC Exchange Program that was enacted through the American Recovery and Reinvestment Act of 2009 (ARRA) automatic and permanent. Specifically, this change to the tax credit would allow states and other allocating agencies to exchange up to half of their allocated 9 percent tax credits at a discounted, fiscally neutral price, up from 40 percent in the ARRA program. For example, the standing offer price might be 80 cents for a dollar of tax credits. States could exercise this option to exchange their allocated, unused tax credits at this price at any time, but they would have an incentive to do so only when the tax credit price falls below $0.80 as a result of reduced demand from investors.

We also recommend a few other extensions to the 2009 exchange program. First, we would open up the exchange option to 4 percent tax credits too. (See below for discussion on determining exchange volume.) Second, we encourage Congress to give states—at least states in high-vacancy, soft market regions—the flexibility to use the dollars that they receive from exchanging their tax credits for demand-side subsidies as well as for construction subsidies. Congress might restrict such rental assistance to households living in LIHTC developments to create a tighter nexus. Such rental subsidies would allow developers of LIHTC developments to serve more residents that earn less than 60 percent of the AMI. Demand-side subsidies would do less to keep construction going, but in many parts of the country the rental affordability problem is less about a lack of supply than it is about stagnant incomes.

The strengths of such an exchange program are clear. Most obviously, it would keep subsidies flowing to affordable housing, even when corporate investors have little, if any, taxable income to offset. In doing so, it would allow for the production and preservation of more affordable housing when investor demand falls and create jobs in the process. Although markets soften and rents can fall on average during recessions, rents at the low end of the market tend to remain stable, both because demand for lower-cost housing can rise and because owners are reluctant to reduce rents, given the need to cover operating and maintenance costs. Figure 1 shows that the share of cost-burdened renters tends to rise, not fall, during economic downturns. Furthermore, by keeping the production and preservation pipeline going (perhaps during periods when NIMBY opposition wanes), the program would also help to address the general shortage of housing in many markets.

The second strength of this proposal is that it would be fiscally neutral. More costs would fall on the appropriations side of the budget, but the tax credit exchange price could be set such that the impact on net tax revenues is neutral. Finally, making the program automatic would add certainty to the market and help to avert temporary disruptions.

These exchanges would mean that some developments would go forward only with public subsidy, losing the discipline of limited, private partners who have a strong incentive to monitor projects and ensure effective compliance. But we believe that the benefits outweigh these potential costs.

Our second recommendation addresses the debt side of the market, since developers need both equity support and reasonably priced loans to produce housing at affordable rents. As noted above, lenders tend to tighten underwriting and cut back on lending during downturns, and investors withdraw from private-label mortgage-backed securities. Fannie Mae and Freddie Mac can help to make up the shortfall, but they are bound by caps limiting their lending. While the FHFA director has the power to adjust caps as market conditions change, there is no guarantee that they will do so.

Thus, we propose to automatically raise caps on GSE purchases of affordable, multifamily loans during downturns when the rest of the commercial real estate industry cuts back on lending activity. Tying adjustments of those caps to increases in local unemployment rates would remove any political considerations and provide certainty to the market. Of course, our proposed automatic adjustment to the GSE multifamily lending caps will have a limited impact if regular caps are raised further and thus are no longer binding.

Finally, both this proposal and the tax credit exchange program would disproportionately benefit households of color, a greater percentage of whom live in rental housing and affordable rental housing in particular. HUD (2018) estimated that 36 percent of LIHTC renters in 2015 were Black and 19.5 percent were Hispanic.

Questions and Concerns

There are naturally details to work out with all three of these sets of proposals, and each has potential risks. In this section, we provide a non-exhaustive discussion of issues around these programs’ designs and implementation challenges.

Would the rental accounts be very expensive?

The initial creation of the accounts would require a large upfront outlay because the accounts are created for every eligible household before they might experience a need for assistance. According to the 2017 AHS, there were approximately 27 million renter households in the United States earning less than 80 percent of AMI. If we limit accounts to those not already receiving federal rental assistance, there are roughly 21 million households that would receive an account. We estimate that prepopulating the account with four times the relevant Fair Market Rent for these households would cost about $5,275 per household. Once the accounts have been created for all eligible households, ongoing costs arise from two sources: new household formation, and saving subsidies on account balances. New household formation is projected to add about 1.1 million households per year for the next decade (McCue 2018). Many of these households will be renters, and a large fraction will be eligible for an account.3

Without accounting for the additional costs of any savings incentives in the accounts, we estimate the 10-year cost of subsidizing the accounts would be $141 billion, or an annualized cost of $14.1 billion. Limiting eligibility more narrowly to households with incomes below 50 percent of AMI would produce a 10-year cost of $8.8 billion, or an annualized cost of just under $9 billion, which is comparable to the annual cost of LIHTC. While this expenditure is significant, the social costs associated with acute housing instability are also sizable—meaning the net cost of the intervention is likely to be much lower.

Is four months of rent really enough?

It is challenging to anticipate the size of subsidy necessary to prevent acute housing instability for a substantial segment of low-income renters. While not all housing instability is captured by eviction court activity, it is instructive to consider the typical amount of arrears that landlords seek in eviction cases. Previous research finds that the typical tenant in housing court owes roughly two months in back rent, according to the landlord (Collinson et al. 2021; Desmond et al. 2013). Additionally, there is strong evidence that even one to two months of emergency rental assistance can be effective at preventing homelessness (Evans, Sullivan, and Wallskog 2016). Undoubtedly, some households will remain housing-unstable even with an emergency account, but the policy is not intended as a replacement for deeper federal rental assistance subsidies.

Would households simply exhaust their accounts immediately to build cash savings?

We do not think this will be especially common for a few reasons. First, the accounts will feature a competitive rate of return on the unused funds, which encourages households to keep funds unspent unless they are faced with an urgent need. Next, there is compelling evidence that low-income households do not treat in-kind benefits as fungible with cash (Hastings and Shapiro 2018). Finally, since the payment must be initiated each month by the tenant, the program will have an implicit default of not making payments. Surely some households might arrange prepayment with their landlords and accrue cash savings from redirecting spending on rent.

These households would still be potentially accumulating savings, however, and those savings could be used to prevent future housing instability.

What is the appropriate local trigger for replenishing the rental accounts and turning on the automatic forbearance for eligible homeowners?

Above, we proposed using the Sahm threshold rule when the unemployment rate rises by 0.5 percentage points above the past 12-month minimum, as a potential trigger for local policies to activate or replenish. This threshold has been shown to be strongly predictive of subsequent distress at a macroeconomic level. Issues may arise when mapping a national rule like this one to a local context, however. First, local unemployment rates are inherently noisier than the national average. Thus, to reduce noise, it might make sense to use a different threshold size for the increase (say, 0.75 percentage points instead of 0.5 percentage points). Next, using a threshold related to the minimum of a series may additionally increase volatility of the programs’ activation. Using a more stable summary statistic, such as the Bolstering the Housing Safety Net: The Promise of Automatic Stabilizers 17 median or 25th percentile of the past 12 months, would lead to smoother transitions. Finally, MSA unemployment may not be reflective of neighborhood conditions, since some parts of the MSA could be in severe distress when the overall MSA unemployment rate remains high. Data limitations might preclude fine-tuning this threshold at a geographic level smaller than the MSA, but we encourage policymakers to explore whether there are sufficiently high-quality and high-frequency granular unemployment data that could be used for the purpose of automatically connecting local distress to local support.

Should the homeowner forbearance program be triggered instead by a qualifying event?

A natural first concern with the AHSP is how to design an appropriate trigger for the program. There is a trade-off between using individual outcomes, such as job loss or income shocks to initiate the forbearance period, and a trigger based on aggregate conditions, such as a rise in local unemployment. While the use of individual outcomes would more narrowly tailor the program to those who can demonstrate need, it also requires active outreach on the part of homeowners in distress who must know about the existence of the program, satisfy the eligibility requirements, and complete the verification and documentation to begin benefit receipt, leading to delays and gaps in take up. An automatic trigger based on the local unemployment rate would obviate the need for action on the part of homeowners to participate, and would be universal and immediate. We believe designing an automatic trigger that removes the decision-making on the part of both homeowners and servicers would greatly enhance the effectiveness of the forbearance period.

Which homeowners should be eligible for the AHSP?

One approach would be to require that all new mortgages (purchase or refinance) written to homeowners with household incomes below 100 percent of local AMI include this automatic forbearance option. This threshold would target those households most at risk of distress and foreclosure, namely the 10–15 percent of most at-risk homeowners. Alternatively, given the direct participation of the federal government in the single-family mortgage market, the FHA, Fannie Mae, or Freddie Mac could include the AHSP as part of any loan they originate. Given the FHA’s focus on first-time buyers (in FY 2020, more than 83 percent of all purchase loans were to first-time buyers), this would be a particularly suitable population to benefit from temporary forbearance, giving them time to explore and determine repayment solutions with their servicers.

Would targeted payment assistance, in the style of the HHF, be preferable to automatic forbearance?

We believe that targeted payment assistance in conjunction with—rather than instead of—forbearance would be the most cost-effective way to address temporary repayment difficulties. Indeed, it is likely that a form of targeted assistance (potentially funded through the proposed Emergency Housing Protections and Relief Act of 2020) will support many homeowners once the national forbearance policies currently in place expire. Forbearance is much less expensive, and, when combined with a servicer liquidity facility, can provide a bridge for many households to a mortgage restructuring that still amortizes the full amount of principal and interest. For some households with extended repayment difficulties, payment assistance may help keep these borrowers in their homes. Regardless, at the expiration of both types of assistance, additional help should be provided to streamline mortgage modifications.

Will a standing offer from the Treasury Department for tax credits crowd out private investors?

While a LIHTC exchange program might potentially crowd out investors who would be willing to purchase credits, this will occur only if the federal government offers to pay a price equal or above the price that investors are willing to pay. To avoid crowd-out, the government can simply set a price that is below typical market levels. States will have an incentive to exchange credits only when investor demand dries up, and the market price falls below this level.

How much subsidy should states receive for four percent credits?

Unlike the competitive 9 percent tax credits, rental developments automatically qualify for the 4 percent LIHTC as long as at least 40 percent of their units are rented at affordable rates to households earning less than 60 percent of the local AMI (or 20 percent are rented at affordable rates to families earning less than half the local AMI) and at least half of their financing comes from tax-exempt, private activity bonds.

Without a clear cap, it is less clear how Congress should decide how many 4 percent credits states should be allowed to exchange, but Congress could base the allowable amount on some percentage of the private activity bond volume caps each state faces, since those caps effectively constrain the use of 4 percent tax credits.

Should states be allowed to convert unused tax credits to demand-side assistance?

We recommend that states be given flexibility to convert unused tax credits to demand-side assistance. A risk of affording such flexibility is that states in supply-constrained markets will convert credits to demand-side assistance when construction is warranted. One potential response would be to restrict the option of conversion to demand-side subsidies to soft markets. That said, we believe the risk of states over-converting to demand-side subsidies is low. Rather, we suspect that states will err on the side of using supply-side subsidies, given the strong support from politically powerful developers and home builders.

Would raising GSE multifamily lending caps add risk to GSE portfolios?

Increasing the multifamily lending caps would add some risk to the GSE portfolio and might crowd out other investors, but we believe risks would be fairly minimal given the historically low default rates for GSE multifamily loans. Even in the wake of the Great Recession, serious delinquency rates for Fannie Mae and Freddie Mac multifamily loans peaked at 0.8 percent and 0.4 percent, respectively (Housing Finance Policy Center 2020). Congress could require that the majority of the loans GSEs support are for affordable housing, which tend to have even lower default rates than market-rate, multifamily loans.

Why not ask the FHA to fill gaps when the volume of private lending to multifamily housing shrinks?

While the FHA has historically played an important role in stabilizing the multifamily market through providing credit when other lenders pull back, the GSEs have far greater capacity. In the wake of the Great Recession, the volume of FHA mortgages rose to $13 billion, as compared to a peak of $67 billion in 2007 for the GSEs (Golding Szymanoski, and Lee 2014; Kaul 2015).

FHA multifamily loan requirements are more complicated and more restrictive than those for GSE products, and fewer lenders participate in the FHA multifamily market. Thus, raising GSE caps to address private multifamily gaps should encourage more multifamily lenders to continue to offer products during downturns.

Conclusion

The brutal inequality of the COVID-19 pandemic has highlighted the value of automatic stabilizers that can help people manage income and financial shocks without losing their homes. When sheltering in place is the best way to protect against a raging virus, being without a home is clearly costly. Yet even without a spreading virus, housing instability is costly to individuals, to communities, and to broader society. Unfortunately, without congressional or regulatory action, our federal housing policies do little to protect against such instability.

We propose three sets of strategies to help make our housing policies and programs more countercyclical. We argue that these adjustments should be automatic, following simple, transparent rules that trigger support, such as when increases in national or local unemployment rates exceed some prespecified threshold. This automation would insulate these decisions from political debates and speed the rate at which money is delivered to struggling households. While each of our strategies has some risks, we believe that their benefits outweigh these potential costs.

To be clear, while we see these proposals as useful and even necessary to address volatility in housing needs, they would do little to address the long-term structural barriers to affordable housing in the United States. Even with these reforms put in place, too many low-income renters would still face unsustainable cost burdens, and restrictive land-use regulations would continue to exclude many homeowners and renters from the markets that offer the greatest opportunities for employment and upward mobility. Regulatory reform at the local level, expansions to the housing voucher program, and other investments in affordable housing would be needed to address these longer-term affordability challenges. But the relatively low-cost proposals we offer here would help to create new safeguards to address the next crisis more quickly.